So, you're diving into the world of Aetna Medicare Supplement plans, huh? If you're here, chances are you're trying to figure out if you're eligible for these supplemental benefits. Don't worry; you're not alone. Navigating Medicare can feel like solving a complex puzzle, especially when you're trying to make sense of all the rules and requirements. But guess what? We've got your back. Let's break it down together, step by step, so you can confidently decide if Aetna Medicare Supplement is right for you.

Now, before we dive deep into the nitty-gritty, let's set the stage. Aetna Medicare Supplement eligibility isn't just about ticking a few boxes. It's about understanding the bigger picture—what you need, what you qualify for, and how these plans can enhance your healthcare experience. Whether you're newly enrolled in Medicare or you've been part of the system for a while, this guide will help you navigate the waters.

One thing to keep in mind as we move forward—Aetna isn't just another insurance provider. They've been in the game for a long time, offering plans that cater to a wide range of needs. So, if you're looking for something that fits your lifestyle and budget, there's a good chance Aetna has got you covered. Let's dig in and find out how!

Read also:Kendrick Lamar And His Daughter A Heartwarming Journey Beyond The Spotlight

Understanding Aetna Medicare Supplement Eligibility

Alright, let's get real. Eligibility for Aetna Medicare Supplement isn't rocket science, but it does come with its own set of rules. First things first, you'll need to be enrolled in Medicare Part A and Part B. That's the bare minimum. Without these, you can't even start thinking about supplemental plans.

Here's the kicker: there's an ideal window to sign up for these plans. It's called the Open Enrollment Period, and it usually happens within six months of when you enroll in Part B. During this time, you can join an Aetna Medicare Supplement plan without having to go through medical underwriting. Translation? No pesky health questions or rejections based on pre-existing conditions.

Key Factors That Impact Your Eligibility

Now, here's where things get interesting. While being enrolled in Part A and Part B is a must, other factors come into play too. For instance, your age matters. If you're under 65, you might still qualify if you meet certain criteria, like having a disability or End-Stage Renal Disease. But let's face it, most people start thinking about Aetna Medicare Supplement when they hit that golden retirement age.

Another thing to consider is where you live. Aetna offers different plans in different regions, so availability might vary depending on your zip code. It's always a good idea to check with a local agent to see what's available in your area.

What Are Aetna Medicare Supplement Plans All About?

Let's take a moment to talk about what Aetna Medicare Supplement plans actually do. These plans are designed to fill the gaps left by Original Medicare. Think of them as the ultimate backup plan. They cover things like copayments, deductibles, and coinsurance, which can add up pretty quickly if you're not careful.

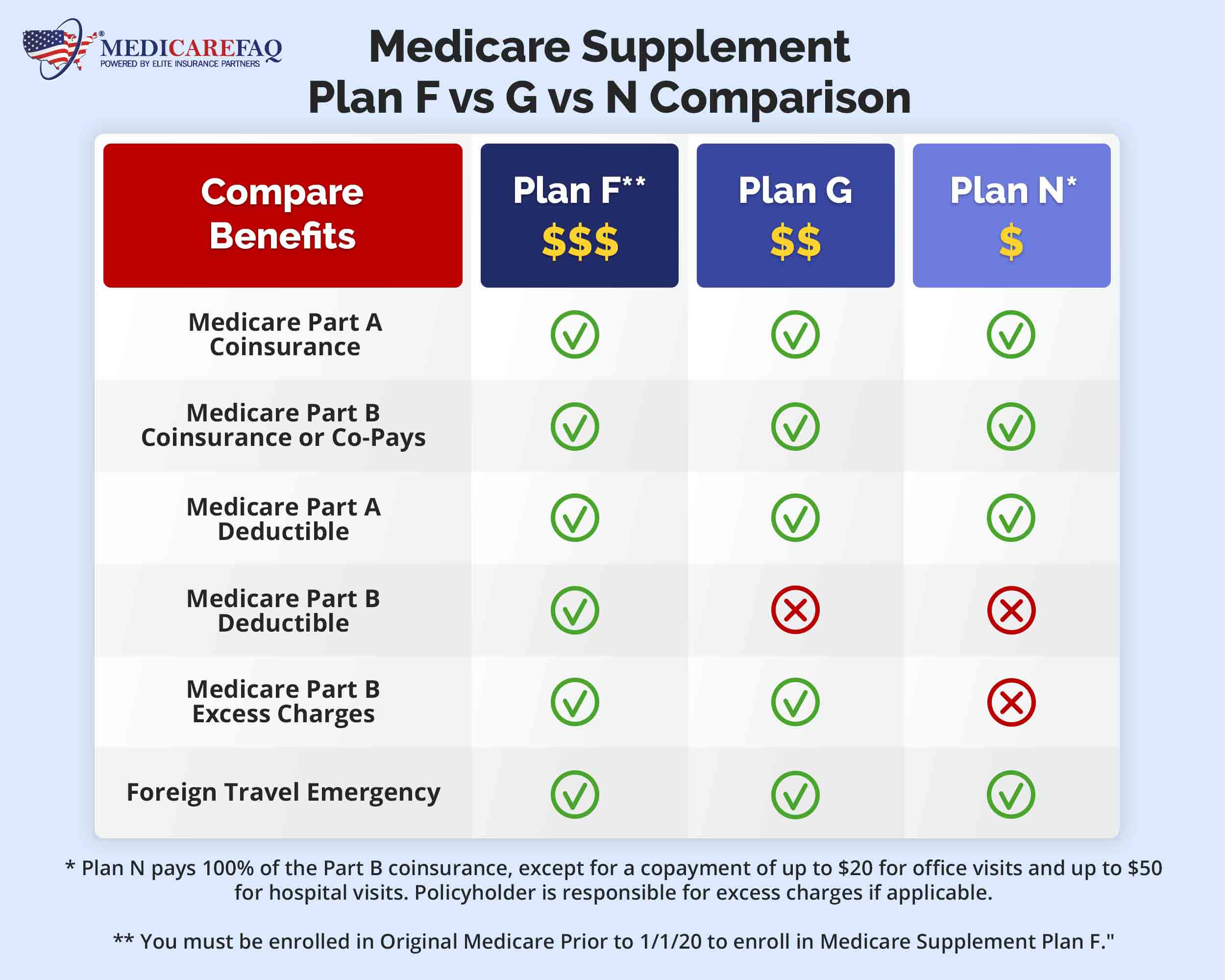

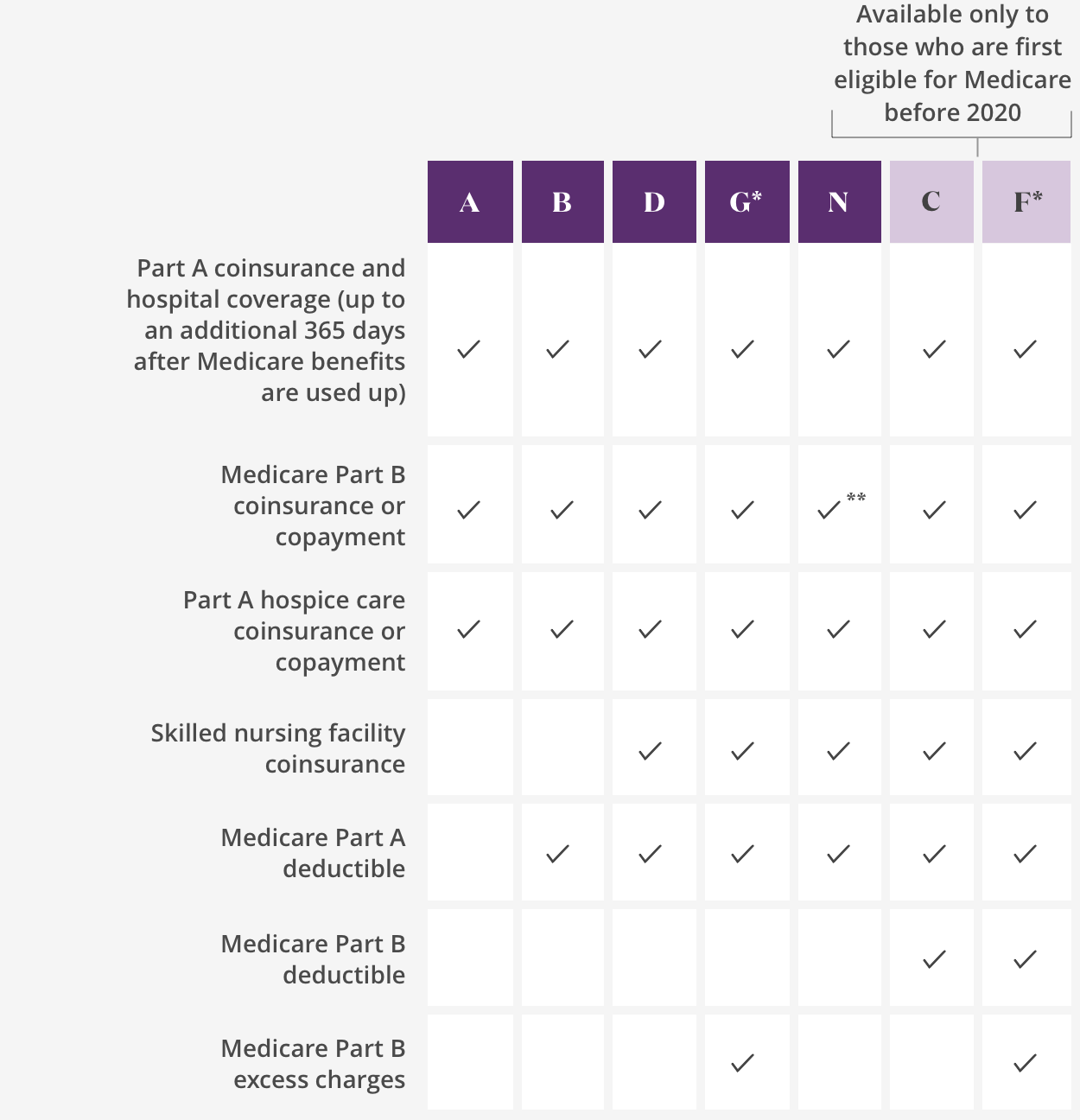

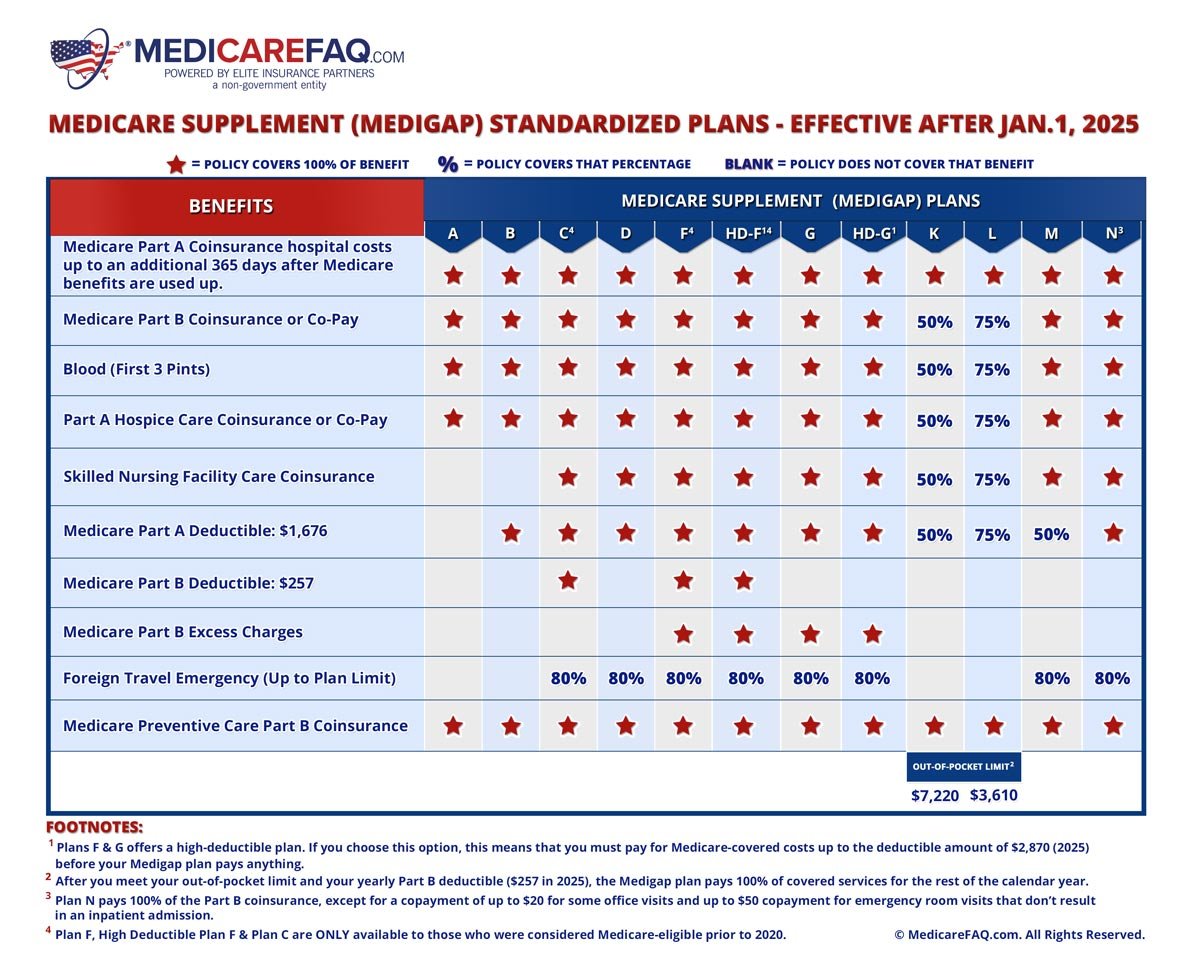

There are different types of plans to choose from, each with its own set of benefits. From Plan A to Plan N, each option caters to different needs and budgets. Some plans offer more comprehensive coverage, while others keep costs lower by limiting benefits. The key is to find the right balance for your situation.

Read also:Unveiling The Mysteries Of Retsu Dao A Deep Dive Into The Ancient Spiritual Practice

Why Choose Aetna Over Other Providers?

Good question. Aetna has a solid reputation in the insurance world. They've been around for over 170 years, which gives them a certain level of authority and trustworthiness. Plus, they offer a wide range of plans to suit different lifestyles. Whether you're an active retiree or someone who prefers a more relaxed pace, Aetna has something for everyone.

Another big plus? Aetna works with a vast network of healthcare providers. This means you have more choices when it comes to doctors and hospitals. And let's be honest, having options is always a good thing.

How to Determine If You're Eligible for Aetna Medicare Supplement

Alright, so you're enrolled in Part A and Part B, and you're within the Open Enrollment Period. Great! But how do you know for sure if you're eligible? Here's where things get a little more personal. Aetna might ask for some additional information, especially if you're outside the ideal enrollment window.

They might want to know about your medical history, current health conditions, and any medications you're taking. This is all part of the underwriting process. Don't panic—it's just a way for them to assess risk and determine which plan is best suited for you.

Steps to Verify Your Eligibility

Ready to check your eligibility? Here's what you need to do:

- Confirm your enrollment in Medicare Part A and Part B.

- Check if you're within the Open Enrollment Period.

- Review any additional requirements based on your age or health status.

- Reach out to an Aetna representative for a personalized assessment.

See? Not too complicated, right?

Common Misconceptions About Aetna Medicare Supplement Eligibility

Before we move on, let's debunk a few myths. There's a lot of misinformation out there, and it's important to set the record straight. For starters, not everyone thinks they need supplemental coverage. Some folks believe that Original Medicare is enough. While it does cover a lot, there are still gaps that can leave you with unexpected bills.

Another misconception is that Aetna Medicare Supplement plans are only for older adults. Sure, most enrollees are 65 and older, but younger folks with qualifying conditions can benefit too. Don't let age be a barrier to exploring your options.

Clearing the Air: Facts vs. Fiction

Here's the truth: Aetna Medicare Supplement plans are designed to give you peace of mind. They help you budget for healthcare costs and ensure you're covered when you need it most. Whether you're young or old, active or retired, these plans can make a big difference in your financial and physical well-being.

Benefits of Aetna Medicare Supplement Plans

So, what's in it for you? Plenty, actually. Aetna Medicare Supplement plans offer a host of benefits that can enhance your healthcare experience. For starters, they provide more predictable costs. No more worrying about unexpected bills or surprise charges. You'll know exactly what you're paying for, which can be a huge relief.

Another perk? Improved access to care. With Aetna's extensive network, you have more options when it comes to choosing doctors and hospitals. And let's not forget the peace of mind that comes with knowing you're covered for things like emergency care and hospital stays.

Additional Perks You Might Not Know About

Did you know that some Aetna plans offer extra benefits like dental, vision, and hearing coverage? These extras can add a lot of value to your overall healthcare package. Plus, Aetna often partners with wellness programs that can help you stay healthy and active as you age.

How to Enroll in Aetna Medicare Supplement Plans

Ready to take the next step? Enrolling in an Aetna Medicare Supplement plan is easier than you might think. You can do it online, over the phone, or even in person. The key is to gather all the necessary information beforehand.

You'll need your Medicare card, some personal details, and any relevant medical information. Once you've got everything ready, you can start the application process. It usually takes a few weeks to get everything finalized, so don't wait until the last minute.

Tips for a Smooth Enrollment Process

Here are a few tips to make the process go smoothly:

- Gather all required documents before you start.

- Choose a plan that fits your needs and budget.

- Double-check all the information you provide.

- Follow up with Aetna if you have any questions or concerns.

Simple, right?

Cost Considerations and Financial Planning

Let's talk money. Aetna Medicare Supplement plans come with premiums, just like any other insurance. The cost can vary based on several factors, including your age, location, and the plan you choose. It's important to factor these costs into your budget when making a decision.

One thing to keep in mind is that premiums can change over time. As you age or if your health status changes, your costs might increase. That's why it's crucial to plan ahead and understand how these changes could impact your finances.

Ways to Manage Costs

Here are some strategies to help you manage costs:

- Shop around for the best rates.

- Consider high-deductible plans if you're healthy and don't anticipate many medical expenses.

- Take advantage of any discounts or programs offered by Aetna.

- Review your plan annually to ensure it still meets your needs.

Final Thoughts and Next Steps

Alright, we've covered a lot of ground. From understanding eligibility to exploring the benefits and costs, you now have a solid foundation for making an informed decision about Aetna Medicare Supplement plans. Remember, the key is to find a plan that fits your unique needs and budget.

So, what's next? If you're ready to move forward, reach out to an Aetna representative. They can help guide you through the enrollment process and answer any questions you might have. And don't forget to share this guide with friends or family who might find it helpful!

Call to Action: Leave a comment below and let us know if you found this guide useful. Or, if you have any questions, feel free to ask—we're here to help!

And there you have it, folks. A comprehensive look at Aetna Medicare Supplement eligibility and everything that comes with it. Now go out there and make the best decision for your healthcare needs!

Table of Contents

- Unlocking Aetna Medicare Supplement Eligibility: Your Ultimate Guide

- Understanding Aetna Medicare Supplement Eligibility

- Key Factors That Impact Your Eligibility

- What Are Aetna Medicare Supplement Plans All About?

- Why Choose Aetna Over Other Providers?

- How to Determine If You're Eligible for Aetna Medicare Supplement

- Steps to Verify Your Eligibility

- Common Misconceptions About Aetna Medicare Supplement Eligibility

- Clearing the Air: Facts vs. Fiction

- Benefits of Aetna Medicare Supplement Plans

- Additional Perks You Might Not Know About

- How to Enroll in Aetna Medicare Supplement Plans

- Tips for a Smooth Enrollment Process

- Cost Considerations and Financial Planning

- Ways to Manage Costs

- Final Thoughts and Next Steps