Ever wondered how much your home is worth? Well, buckle up because we’re diving deep into the world of Chase Home Value Estimator! This powerful tool isn’t just a number-cruncher—it’s your secret weapon for understanding your property’s true value. Whether you’re planning to sell, refinance, or just curious, this estimator has got your back. Let’s break it down step by step so you can make smarter decisions about your most valuable asset.

In today’s fast-paced real estate market, knowing your home’s value is more important than ever. With the Chase Home Value Estimator, you get access to cutting-edge technology that analyzes a wide range of factors to give you an accurate estimate. It’s not just a guess—it’s a data-driven assessment that considers everything from location to market trends.

But here’s the thing: not all estimators are created equal. The Chase tool stands out because it’s designed with homeowners like you in mind. It’s user-friendly, reliable, and packed with features that make it a go-to resource for anyone looking to understand their property’s worth. So, let’s explore how it works, why it matters, and how you can use it to your advantage.

Read also:Top Things To Do In Chapel Hill A Locals Guide To Fun And Adventure

Ready to take control of your home’s value? Let’s get started!

What is Chase Home Value Estimator?

The Chase Home Value Estimator is essentially an online platform that provides homeowners with a quick and easy way to estimate their property’s current market value. Unlike traditional appraisal methods, which can take weeks and cost a pretty penny, this tool delivers instant results right at your fingertips. It’s like having a personal real estate expert in your pocket—minus the hefty fees.

How Does Chase Home Value Estimator Work?

Behind the scenes, the estimator uses advanced algorithms to analyze a variety of data points. These include:

- Comparable sales in your area (aka “comps”)

- Property characteristics such as square footage, number of bedrooms, and amenities

- Local market conditions and trends

- Historical price fluctuations

By combining all these factors, the estimator generates a detailed report that gives you a clear picture of your home’s estimated value. It’s not perfect, but it’s a great starting point for anyone looking to get a rough idea of what their property might be worth.

Why Should You Use Chase Home Value Estimator?

There are plenty of reasons why the Chase Home Value Estimator is worth your time. First off, it’s completely free—no strings attached. You don’t have to sign up for anything or give away your personal information unless you want to. Plus, it’s super easy to use, even if you’re not a real estate guru.

Here are some key benefits:

Read also:Norm Woodworking Your Ultimate Guide To Mastering The Craft

- Instant results: Get a valuation estimate in minutes.

- Accuracy: Powered by data from trusted sources.

- Convenience: Accessible anytime, anywhere.

- Privacy: No need to invite strangers into your home for an appraisal.

Whether you’re thinking about selling, refinancing, or just curious about your home’s value, this tool can help you make informed decisions. And let’s face it, in today’s competitive market, knowledge is power.

How Accurate is Chase Home Value Estimator?

This is one of the most common questions people ask, and the answer isn’t black and white. While the Chase Home Value Estimator is generally pretty accurate, it’s important to remember that it’s still just an estimate. Factors like unique property features, renovations, or market anomalies can sometimes throw off the results.

Factors That Affect Accuracy

Here are a few things that can impact the accuracy of your home value estimate:

- Recent renovations or upgrades

- Unusual property characteristics (e.g., custom architecture)

- Market conditions in your specific neighborhood

- Data limitations (e.g., outdated records)

That said, the estimator is constantly being updated with new data to improve its accuracy. So while it might not be 100% spot-on, it’s still a valuable tool for getting a general sense of your home’s value.

Step-by-Step Guide to Using Chase Home Value Estimator

Now that you know what the Chase Home Value Estimator is and why it’s useful, let’s walk through how to use it. Don’t worry—it’s super simple!

Step 1: Visit the Chase Website

Head over to the official Chase website and navigate to the Home Value Estimator page. You can usually find it under the “Mortgage” or “Real Estate” section.

Step 2: Enter Your Property Information

You’ll need to provide some basic details about your home, such as:

- Address

- Square footage

- Number of bedrooms and bathrooms

- Year built

Don’t worry if you don’t have all the info—it’ll still work with what you provide.

Step 3: Review Your Estimate

Once you’ve entered your details, the estimator will crunch the numbers and give you an estimated value for your home. You’ll also get a breakdown of the factors that influenced the result, which can be really helpful for understanding how the estimate was calculated.

What Sets Chase Home Value Estimator Apart?

There are tons of property valuation tools out there, so what makes the Chase estimator stand out? For starters, it’s backed by one of the biggest and most trusted financial institutions in the world. Chase has access to a wealth of data and resources that smaller companies simply can’t match.

Plus, the tool is designed specifically for homeowners, which means it’s intuitive and easy to use. You don’t need a degree in real estate to figure it out. And because Chase is constantly updating its algorithms and data sources, you can trust that you’re getting the latest and most accurate information available.

Common Misconceptions About Chase Home Value Estimator

There are a few myths floating around about property valuation tools in general, and the Chase estimator is no exception. Let’s bust some of those misconceptions:

Myth #1: It’s Only for Chase Customers

Wrong! Anyone can use the Chase Home Value Estimator, regardless of whether you’re a Chase customer or not. It’s completely free and open to the public.

Myth #2: It’s Just a Guess

While it’s true that the estimator isn’t 100% perfect, it’s far from a random guess. The tool uses sophisticated algorithms and real-time data to generate its estimates, making it one of the most reliable options available.

Myth #3: It Replaces Traditional Appraisals

Not quite. While the estimator is a great way to get a ballpark figure, it’s no substitute for a professional appraisal if you’re planning to sell or refinance. However, it’s still an excellent tool for getting a quick and easy estimate.

Tips for Getting the Most Out of Chase Home Value Estimator

Want to make sure you’re getting the best possible results? Here are a few tips:

- Provide as much information as possible when entering your property details.

- Double-check your address to ensure accuracy.

- Compare the estimate with other tools to get a well-rounded view.

- Consider recent renovations or upgrades that might not be reflected in the data.

By following these tips, you’ll be able to get a more accurate and reliable estimate of your home’s value.

Real-Life Examples of Chase Home Value Estimator in Action

Let’s look at a couple of real-world scenarios where the Chase Home Value Estimator can come in handy:

Example #1: Selling Your Home

Imagine you’re thinking about putting your house on the market. Before you list it, you want to know what it’s worth so you can set a competitive price. By using the Chase estimator, you can get a rough idea of your home’s value and use that information to guide your pricing strategy.

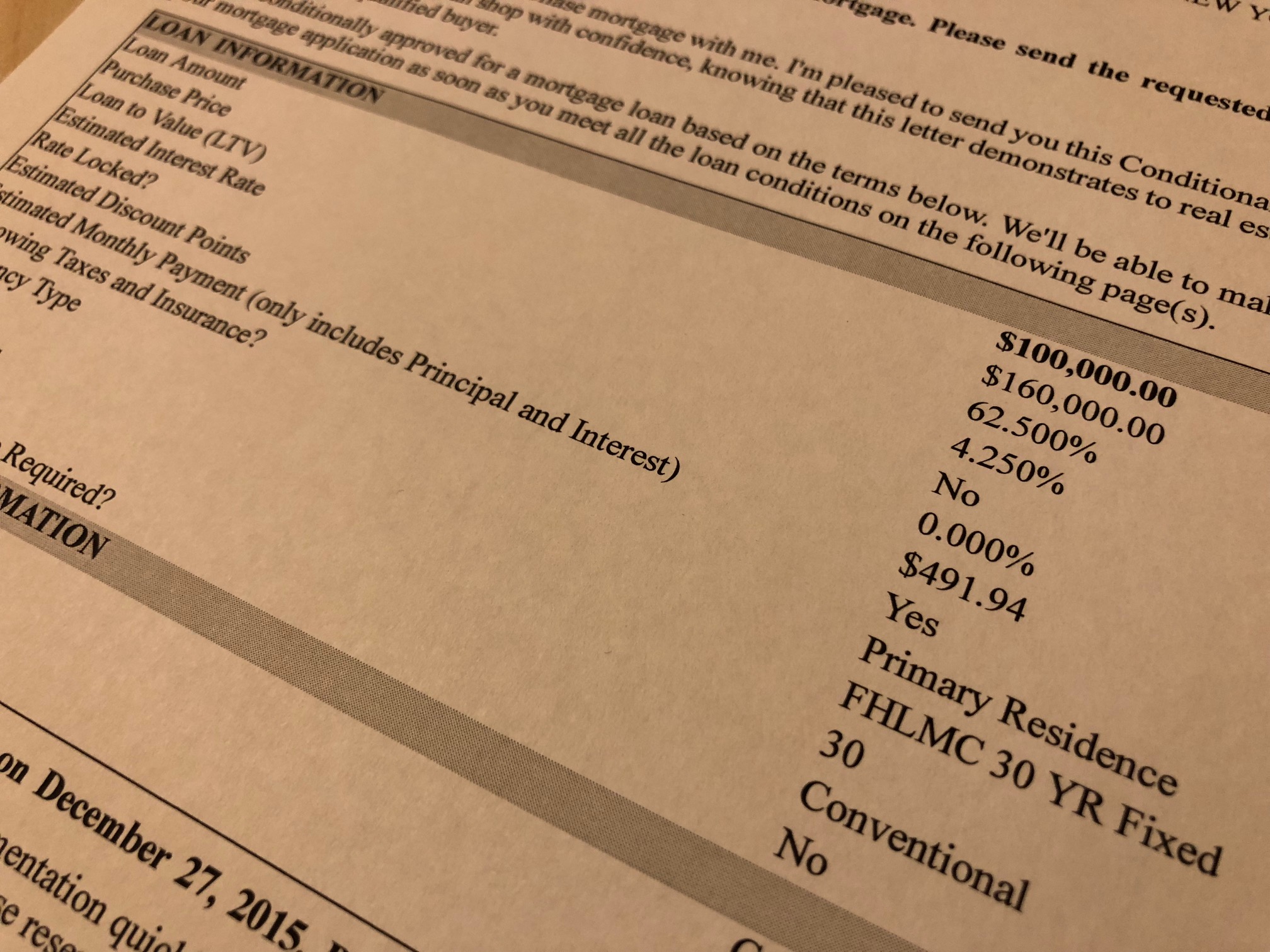

Example #2: Refinancing Your Mortgage

Say you’re considering refinancing your mortgage to take advantage of lower interest rates. Knowing your home’s current value can help you determine how much equity you have and whether refinancing is a good option for you. The Chase estimator can give you the info you need to make an informed decision.

Conclusion: Take Control of Your Home’s Value Today

There you have it—everything you need to know about the Chase Home Value Estimator. This powerful tool can help you unlock the full potential of your property and make smarter decisions about your financial future. Whether you’re planning to sell, refinance, or just curious about your home’s worth, this estimator is a valuable resource that belongs in every homeowner’s toolkit.

So what are you waiting for? Head over to the Chase website and give it a try. And don’t forget to share your experience in the comments below—we’d love to hear how it worked for you!

Table of Contents

What is Chase Home Value Estimator?

How Does Chase Home Value Estimator Work?

Why Should You Use Chase Home Value Estimator?

How Accurate is Chase Home Value Estimator?

Step-by-Step Guide to Using Chase Home Value Estimator

What Sets Chase Home Value Estimator Apart?

Common Misconceptions About Chase Home Value Estimator

Tips for Getting the Most Out of Chase Home Value Estimator