Let’s get real here—if you’re reading this, chances are you’ve got questions about Virginia state tax. Maybe you’ve just moved to the Old Dominion State, or maybe you’re trying to figure out how much of your hard-earned money goes to Uncle Sam and the Commonwealth. Whatever the reason, you’re in the right place. In this article, we’ll break down everything you need to know about Virginia state tax in simple terms—no boring legalese or complicated jargon.

Now, before we dive into the nitty-gritty, let’s talk about why understanding Virginia state tax is so important. If you’re like most people, taxes can feel like a confusing maze of numbers and rules. But trust me, knowing your tax obligations can save you a ton of headaches—and maybe even some money. So buckle up, because we’re about to demystify the world of Virginia state tax together.

This article isn’t just about throwing random facts at you. We’ll cover everything from the basics of Virginia state tax to specific rates, deductions, and credits that could help you save big time. By the end of this, you’ll be equipped with the knowledge to navigate the tax system like a pro. Ready? Let’s go!

Read also:Shell Gasoline Rewards Unlocking Savings At The Pump

Understanding Virginia State Tax: The Basics

Alright, let’s start with the basics. What exactly is Virginia state tax? Simply put, it’s a tax imposed by the state of Virginia on individuals, businesses, and other entities that earn income within its borders. This tax helps fund essential services like education, healthcare, infrastructure, and public safety. Think of it as your contribution to keeping the state running smoothly.

Virginia state tax is based on your taxable income, which is calculated after subtracting certain deductions and exemptions from your gross income. The state uses a progressive tax system, meaning the more you earn, the higher the tax rate you’ll pay. But don’t worry—we’ll break all of this down in the next section.

Who Needs to Pay Virginia State Tax?

Here’s the deal: if you live in Virginia or earn income from sources within the state, you’re probably required to pay Virginia state tax. This includes residents, nonresidents who work in Virginia, and businesses operating in the state. Even if you’re just visiting for a short time, you might still be subject to certain taxes, like sales tax.

Let’s break it down further:

- Residents: If you live in Virginia for most of the year, you’re considered a resident and must file a Virginia tax return.

- Nonresidents: If you live outside Virginia but earn income from sources within the state, you’ll need to file a part-year or nonresident tax return.

- Businesses: Companies that operate in Virginia are also subject to state taxes, including corporate income tax and sales tax.

Virginia State Tax Rates: How Much Do You Owe?

Now that we’ve covered who needs to pay Virginia state tax, let’s talk about the rates. As of 2023, Virginia uses a progressive tax system with four tax brackets. Here’s a quick rundown:

Virginia State Income Tax Brackets:

Read also:Arizona Mesa Airport Your Gateway To Adventure And Beyond

- 2% on the first $3,000 of taxable income

- 3% on income between $3,001 and $5,000

- 5% on income between $5,001 and $17,000

- 5.75% on income above $17,001

As you can see, the tax rate increases as your income goes up. But here’s the good news: Virginia offers several deductions and credits that can help lower your taxable income. We’ll dive deeper into those later.

How Do I Calculate My Virginia State Tax?

Calculating your Virginia state tax isn’t as scary as it sounds. Here’s a step-by-step guide:

- Determine your gross income from all sources.

- Subtract any allowable deductions and exemptions to arrive at your taxable income.

- Apply the appropriate tax rate based on your taxable income.

For example, let’s say you earn $40,000 per year. After subtracting deductions and exemptions, your taxable income is $30,000. Using the tax brackets above, you’d pay:

- 2% on the first $3,000 = $60

- 3% on the next $2,000 = $60

- 5% on the next $12,000 = $600

- 5.75% on the remaining $13,000 = $747.50

Total tax owed: $1,467.50

Virginia Sales Tax: What You Need to Know

While we’re talking about Virginia state tax, we can’t forget about sales tax. Virginia imposes a statewide sales tax of 4.3%, but some localities add additional taxes, bringing the total rate to as high as 6%. This tax applies to most goods and services, so it’s something you’ll encounter regularly in your day-to-day life.

Here’s a breakdown of the sales tax rates in Virginia:

- Statewide sales tax: 4.3%

- Local sales tax: Varies by locality (up to 1.7%)

- Total sales tax: Up to 6%

What’s Taxable in Virginia?

Not everything you buy is subject to sales tax. Here’s a list of items that are typically taxable in Virginia:

- Clothing and footwear (above $100)

- Groceries (at a reduced rate of 1%)

- Restaurant meals

- Motor vehicles

- Services like cable TV and internet

On the flip side, some items are exempt from sales tax, such as prescription medications and certain medical devices. Always check with a tax professional or the Virginia Department of Taxation for the latest rules.

Virginia Tax Deductions and Credits: Saving You Money

One of the best ways to reduce your Virginia state tax bill is by taking advantage of deductions and credits. These are essentially discounts or reductions in your taxable income or tax liability. Let’s take a look at some of the most common ones:

Standard Deduction vs. Itemized Deductions

Virginia allows taxpayers to choose between a standard deduction or itemized deductions. The standard deduction is a fixed amount that depends on your filing status. For example, single filers can deduct $3,000, while married filers filing jointly can deduct $6,000.

If you have significant expenses like mortgage interest, charitable donations, or medical bills, you might benefit more from itemizing your deductions. It’s all about finding the option that gives you the biggest tax break.

Popular Tax Credits in Virginia

Virginia offers several tax credits that can help lower your tax bill. Some of the most popular ones include:

- Child and Dependent Care Credit: Helps offset the cost of childcare expenses.

- Earned Income Credit: Provides a tax break for low- to moderate-income taxpayers.

- Elderly or Disabled Exemption: Reduces property taxes for qualifying seniors and disabled individuals.

- Education Credits: Offers tax relief for qualified education expenses.

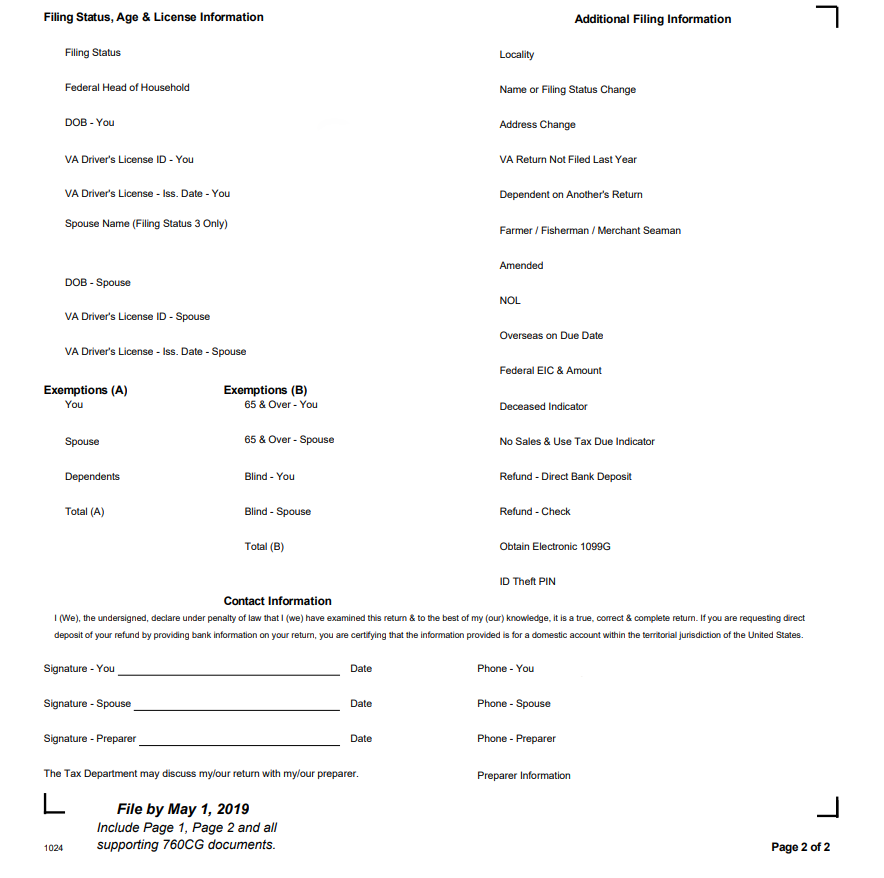

Filing Your Virginia State Tax Return

Now that you know how Virginia state tax works, it’s time to talk about filing your tax return. The deadline for filing is typically April 15th, but extensions are available if you need more time. You can file your return online through the Virginia Department of Taxation’s website or use a tax preparation software like TurboTax.

What Documents Do I Need?

Gathering the right documents is key to a smooth filing process. Here’s a list of what you’ll need:

- W-2 forms from your employer(s)

- 1099 forms for freelance or investment income

- Receipts for deductible expenses

- Records of any tax credits or exemptions you qualify for

Tips for Maximizing Your Virginia State Tax Refund

Who doesn’t love getting a tax refund? While there’s no guarantee you’ll get one, there are steps you can take to increase your chances:

Claim All Available Deductions and Credits

Make sure you’re not leaving money on the table by missing out on deductions and credits. Double-check your calculations and consult a tax professional if you’re unsure about anything.

Adjust Your Withholding

If you’re getting a large refund every year, it might be a sign that you’re having too much tax withheld from your paycheck. Adjusting your withholding can help you keep more money throughout the year instead of waiting for a refund.

Common Mistakes to Avoid When Filing Virginia State Tax

Filing your tax return can be stressful, but avoiding common mistakes can make the process smoother. Here are a few things to watch out for:

1. Forgetting to Report All Income

Make sure you include all sources of income on your tax return, including freelance work, side gigs, and investments. Failing to report income can lead to penalties and interest charges.

2. Incorrect Social Security Number

Double-check that you’ve entered your Social Security number correctly. A simple typo can cause delays in processing your return.

3. Missing Deadlines

File your return on time to avoid late filing penalties. If you need more time, file for an extension before the deadline.

Where to Get Help with Virginia State Tax

If you’re feeling overwhelmed by the tax process, don’t worry—you’re not alone. There are plenty of resources available to help you navigate Virginia state tax:

Virginia Department of Taxation

The Virginia Department of Taxation’s website is a great place to start. They offer a wealth of information, including tax forms, filing instructions, and FAQs.

Tax Professionals

If you prefer a hands-off approach, consider hiring a tax professional. They can handle all the details for you and ensure your return is filed correctly.

Conclusion: Take Control of Your Virginia State Tax

And there you have it—a comprehensive guide to understanding Virginia state tax. Whether you’re a resident, nonresident, or business owner, knowing your tax obligations is crucial for financial success. By familiarizing yourself with the basics, taking advantage of deductions and credits, and avoiding common mistakes, you can minimize your tax burden and maximize your refund.

So what’s next? If you found this article helpful, don’t forget to share it with your friends and family. And if you have any questions or comments, feel free to leave them below. Together, we can make tax season a little less stressful—one state at a time.

Table of Contents

- Understanding Virginia State Tax: The Basics

- Virginia State Tax Rates: How Much Do You Owe?

- Virginia Sales Tax: What You Need to Know

- Virginia Tax Deductions and Credits: Saving You Money

- Filing Your Virginia State Tax Return

- Tips for Maximizing Your Virginia State Tax Refund

- Common Mistakes to Avoid When Filing Virginia State Tax

- Where to Get Help with Virginia State Tax

- Conclusion: Take Control of Your Virginia State Tax