Alright, buckle up, because we're diving deep into the world of ABA banking. If you've ever scratched your head wondering what this financial jargon means, you're in the right place. ABA banking might sound like a mouthful, but it's actually pretty straightforward once you get the hang of it. So, let's break it down and make it super easy to digest.

Now, picture this: you're navigating the complex world of banking, and suddenly you come across the term "ABA." What is it? Why does it matter? Well, my friend, ABA banking is all about making financial transactions smooth, secure, and efficient. Think of it as the secret sauce that keeps the banking system running like a well-oiled machine.

Before we dive deeper, let's set the stage. ABA banking is more than just a buzzword; it's a crucial part of how banks operate behind the scenes. Whether you're transferring funds, setting up direct deposits, or even paying bills online, ABA plays a significant role in ensuring everything works seamlessly. So, are you ready to uncover the mystery? Let's go!

Read also:Understanding The Truth Behind Michael Jacksons Vitiligo

Understanding the Basics of ABA Banking

First things first, ABA stands for the American Bankers Association. Yep, it's not just a random acronym; it's a legit organization that sets the standards for banking operations in the U.S. The ABA routing number, also known as the routing transit number (RTN), is a nine-digit code that banks use to identify themselves. Think of it as a bank's social security number—it's unique to each financial institution.

Here's the cool part: this number helps banks communicate with each other during transactions. For instance, when you transfer money from one bank to another, the ABA routing number ensures the funds end up in the right account. Without it, the banking system would be chaos. Imagine sending a package without an address—it'd never reach its destination, right?

What Does ABA Banking Actually Do?

ABA banking isn't just about routing numbers; it's about creating a standardized system that benefits everyone. Banks use ABA guidelines to streamline processes, reduce errors, and enhance security. Here's a quick rundown of what ABA banking does:

- Facilitates seamless fund transfers between banks

- Ensures accurate processing of checks and electronic payments

- Provides a secure framework for financial transactions

- Helps prevent fraud by verifying bank identities

So, the next time you see "ABA" on a bank statement or form, you'll know it's the backbone of the entire banking process. Pretty impressive, huh?

Why Is ABA Banking Important?

Let's face it: banking can be complicated. Between different institutions, accounts, and payment methods, things can get messy fast. That's where ABA banking comes in. By establishing clear standards and protocols, ABA ensures that everything runs smoothly. Here's why it matters:

For starters, ABA banking promotes consistency across the board. Whether you're dealing with a local credit union or a giant multinational bank, the same rules apply. This uniformity makes it easier for consumers and businesses to navigate the financial landscape. Plus, it gives everyone peace of mind knowing their transactions are secure and reliable.

Read also:Boosting Atampt Customer Loyalty The Ultimate Guide For Modern Consumers

How Does ABA Banking Impact You?

Now, you might be wondering, "How does this affect me?" Well, ABA banking impacts your daily life more than you realize. Every time you deposit a check, set up a direct deposit, or pay a bill online, ABA routing numbers are at work behind the scenes. They ensure your money goes where it's supposed to go, without any hiccups.

Think about it: if banks didn't have a standardized system, every transaction would be a guessing game. Would your paycheck land in the right account? Would your utility bill get paid on time? Probably not. Thanks to ABA banking, you can rest easy knowing your finances are in good hands.

The History of ABA Banking

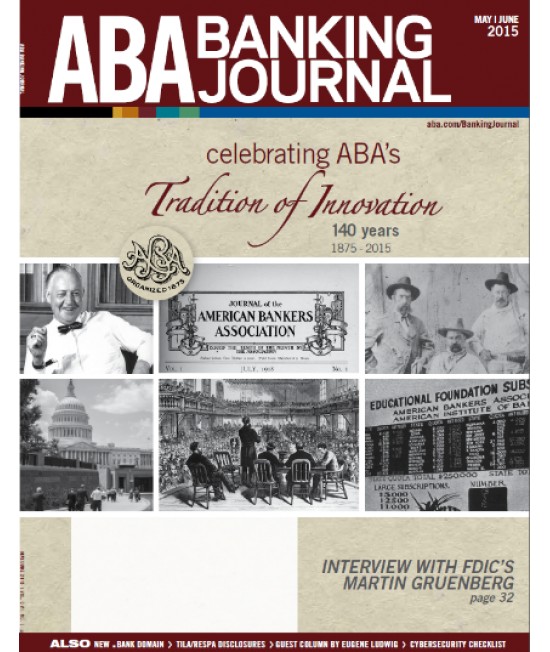

ABA banking didn't just pop up overnight. It has a rich history that dates back to the early 20th century. In 1910, the American Bankers Association introduced the routing transit number system to simplify check processing. Back then, banks were struggling to keep up with the growing demand for financial services. The ABA stepped in and created a solution that would revolutionize the industry.

Over the years, ABA banking has evolved to meet the changing needs of consumers and businesses. From paper checks to electronic payments, the system has adapted to new technologies while maintaining its core principles. Today, ABA routing numbers are an integral part of the modern banking infrastructure.

Evolution of ABA Banking

Let's take a quick trip down memory lane to see how ABA banking has evolved:

- 1910: Introduction of the routing transit number system

- 1950s: Expansion to include electronic fund transfers

- 1980s: Adoption of automated clearing house (ACH) payments

- 2000s: Integration with online and mobile banking platforms

As you can see, ABA banking has come a long way. What started as a simple system for processing checks has grown into a sophisticated network that powers billions of transactions every year. And it's not slowing down anytime soon.

How ABA Banking Works

Alright, let's get into the nitty-gritty of how ABA banking works. At its core, it's all about the routing transit number. This nine-digit code is divided into three parts:

- First four digits: Federal Reserve routing symbol

- Next four digits: Bank identifier

- Last digit: Check digit for validation

When you initiate a transaction, the ABA routing number tells the system which bank to connect with. It's like a digital handshake that ensures everyone is on the same page. Once the connection is established, the transaction can proceed smoothly.

Behind the Scenes: ABA Banking in Action

Here's a sneak peek at what happens behind the scenes when you use ABA banking:

- Step 1: You initiate a transaction (e.g., deposit a check)

- Step 2: The ABA routing number identifies your bank

- Step 3: The system verifies the transaction details

- Step 4: Funds are transferred securely to the recipient

It's a seamless process that happens in the blink of an eye. And the best part? You don't have to lift a finger. ABA banking takes care of everything for you.

Benefits of ABA Banking

Now that we've covered the basics, let's talk about the benefits of ABA banking. There are plenty of reasons why this system is so popular. Here are just a few:

- Efficiency: Transactions are processed quickly and accurately

- Security: ABA routing numbers help prevent fraud and unauthorized access

- Convenience: You can manage your finances from anywhere with ease

- Reliability: The system has a proven track record of success

Whether you're a busy professional or a stay-at-home parent, ABA banking makes life easier. It eliminates the hassle of manual processes and gives you the freedom to focus on what matters most.

Who Benefits from ABA Banking?

ABA banking isn't just for big corporations; it benefits everyone. From small business owners to everyday consumers, the system provides equal opportunities for all. Here's how different groups benefit:

- Consumers: Enjoy secure and convenient banking services

- Businesses: Streamline operations and reduce costs

- Banks: Improve efficiency and enhance customer satisfaction

It's a win-win situation for everyone involved. That's why ABA banking has become such a vital part of the financial ecosystem.

Common Misconceptions About ABA Banking

Let's clear up some common misconceptions about ABA banking. There's a lot of misinformation out there, so it's important to set the record straight. Here are a few myths and the truth behind them:

- Myth: ABA routing numbers are only for checks

- Truth: They're used for all types of transactions, including ACH payments

- Myth: ABA banking is outdated

- Truth: It's constantly evolving to meet modern needs

- Myth: ABA routing numbers are universal

- Truth: Each bank has its own unique routing number

By understanding the facts, you can make informed decisions about your finances. Don't let misconceptions cloud your judgment.

How to Avoid ABA Banking Scams

With the rise of online banking, scams have become more common. Here are some tips to protect yourself:

- Verify ABA routing numbers before initiating transactions

- Use secure platforms for online banking

- Monitor your accounts regularly for suspicious activity

Stay vigilant and trust your instincts. If something seems off, it probably is. Better safe than sorry, right?

Future of ABA Banking

So, what's next for ABA banking? As technology continues to evolve, so will the system. We can expect to see even more innovations in the years to come. Here are a few possibilities:

- Increased use of blockchain technology for secure transactions

- Integration with artificial intelligence for enhanced fraud detection

- Expansion into new markets and industries

One thing's for sure: ABA banking will continue to play a vital role in the financial world. It's a system that adapts and thrives, ensuring that everyone has access to safe and reliable banking services.

Preparing for the Future

To stay ahead of the curve, it's important to educate yourself about the latest trends in ABA banking. Keep an eye on industry news and updates, and don't hesitate to ask questions. Your bank is there to help, so take advantage of their resources.

By staying informed, you can make the most of ABA banking and all it has to offer. Who knows? You might even discover new ways to manage your finances that you never thought possible.

Conclusion

Well, there you have it—a comprehensive guide to ABA banking. From its origins to its future, we've covered everything you need to know. ABA banking might seem complex at first, but once you understand the basics, it's actually quite simple.

Remember, the key to successful banking is knowledge. By familiarizing yourself with ABA routing numbers and how they work, you can take control of your financial future. And don't forget to stay vigilant against scams and misinformation.

So, what are you waiting for? Dive into the world of ABA banking and see how it can transform your financial life. Share this article with your friends and family, and let's spread the word about the power of ABA banking. Together, we can create a safer, more efficient banking system for everyone.

Table of Contents

![ABA Banking Industry Response List Review cat[&]tonic](https://cat-tonic.com/wp-content/uploads/may20FD01_blog_image.jpg)