Listen up, folks. If you’re living in Virginia or planning to do business here, there’s one thing you absolutely need to know: the Virginia Department of Taxation. This isn’t just some random office—it’s the backbone of how taxes are managed in the state. From income tax to sales tax, and everything in between, this department plays a crucial role in keeping Virginia’s financial system running smoothly. So, buckle up, because we’re about to break it all down for you.

Now, I get it. Taxes can be a headache. The forms, the deadlines, the jargon—it’s enough to make anyone’s brain spin. But don’t worry, we’re here to simplify it for you. Whether you’re a resident, a business owner, or just someone curious about how Virginia handles its finances, this article has got you covered. We’ll dive deep into what the Virginia Department of Taxation does, how it affects you, and how you can make sure you’re staying compliant.

And hey, who doesn’t love saving money, right? By the end of this, you’ll have a solid understanding of how the department operates, what taxes you’re responsible for, and even some tips to help you avoid common pitfalls. So, let’s get started and demystify the world of Virginia taxes together.

Read also:Verizon Fiber Optic Revolutionizing Highspeed Internet For Everyone

Understanding the Virginia Department of Taxation

What Exactly is the Virginia Department of Taxation?

Alright, let’s start with the basics. The Virginia Department of Taxation, often referred to as VDOT (not to be confused with the Department of Transportation), is the state agency responsible for administering Virginia’s tax laws. Think of it as the tax police—but in a good way. They’re the ones who ensure that everyone pays their fair share while also providing resources to help taxpayers understand their obligations.

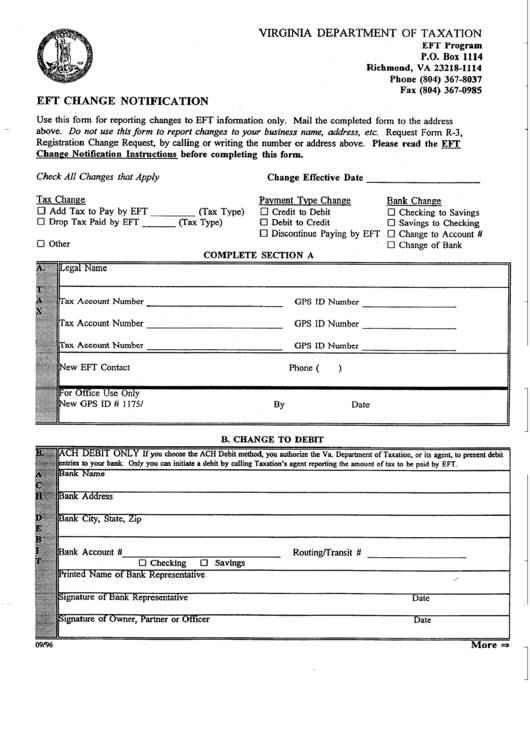

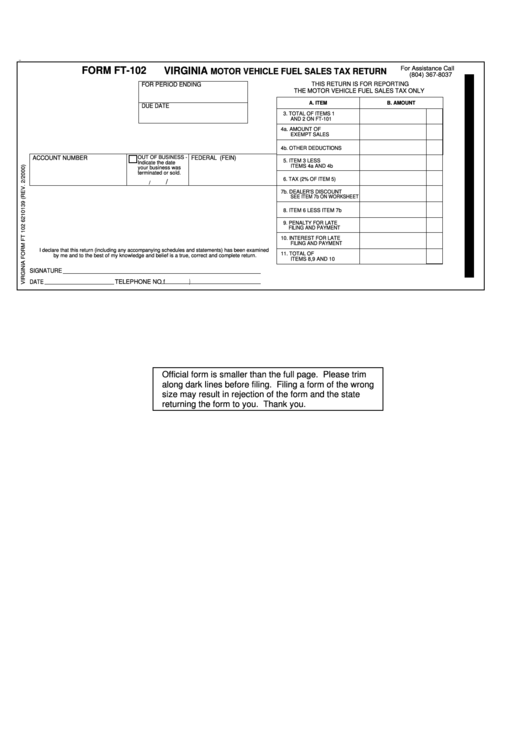

The department oversees a wide range of taxes, including individual income tax, corporate income tax, sales and use tax, and more. They’re also responsible for processing returns, collecting payments, and enforcing tax laws. Basically, if it has anything to do with taxes in Virginia, the Department of Taxation is involved.

Key Responsibilities of the Department

Here’s a quick rundown of what the Virginia Department of Taxation does:

- Administering Tax Laws: They make sure that all tax laws are followed by both individuals and businesses.

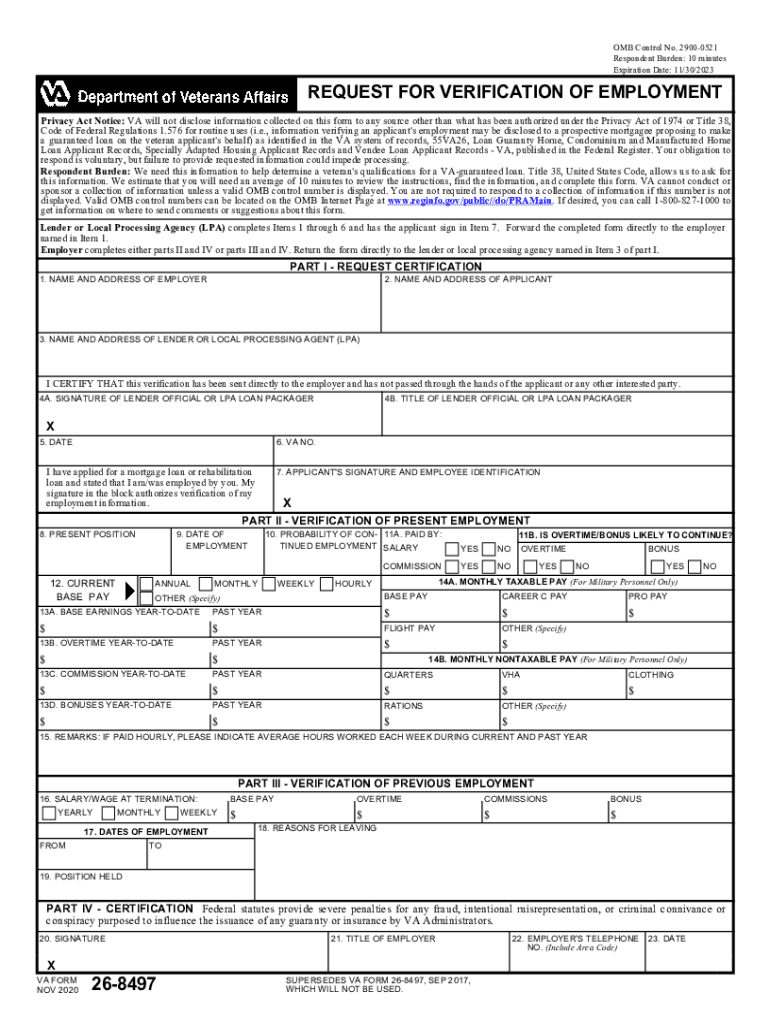

- Processing Tax Returns: Whether you’re filing your personal income tax or your business’s corporate tax, they’re the ones who handle it.

- Collecting Taxes: They ensure that the right amount of tax is collected from everyone, and they have the power to enforce penalties if someone doesn’t pay up.

- Providing Guidance: They offer resources and assistance to help taxpayers understand their responsibilities and navigate the tax system.

It’s not just about collecting money, though. The department also plays a role in shaping tax policy and ensuring that the state’s financial systems are fair and efficient.

Types of Taxes Managed by the Department

Individual Income Tax

Let’s talk about the big one: individual income tax. If you earn money in Virginia, chances are you’re subject to state income tax. The Virginia Department of Taxation sets the rates and determines how much you owe based on your income. As of the latest data, Virginia uses a graduated tax rate system, meaning the more you earn, the higher percentage of your income goes to taxes.

But here’s the good news: Virginia offers a variety of deductions and credits to help lower your tax burden. From standard deductions to education credits, there are plenty of ways to reduce what you owe. Just make sure you’re keeping track of all your expenses and receipts throughout the year—it’ll make filing season a lot easier.

Read also:Amtrak Stations Near Washington Dc Your Ultimate Guide For Seamless Travel

Sales and Use Tax

Next up, we have sales and use tax. This one affects pretty much everyone in Virginia. Whenever you buy something, whether it’s a cup of coffee or a new car, chances are you’re paying sales tax. The current rate is around 4.3%, but it can vary depending on the location and the type of purchase.

Use tax, on the other hand, applies to items purchased out of state but used in Virginia. If you didn’t pay sales tax at the time of purchase, you might still owe use tax. It’s a bit tricky, but the Department of Taxation provides guidelines to help you figure it out.

How to File Your Taxes in Virginia

Steps to Filing Your State Taxes

Filing your taxes doesn’t have to be a nightmare. Here’s a step-by-step guide to help you through the process:

- Gather Your Documents: Make sure you have all your income statements, receipts, and other relevant paperwork ready.

- Choose Your Filing Method: You can file electronically or by mail. E-filing is usually faster and more convenient.

- Fill Out the Forms: Use the appropriate forms provided by the Virginia Department of Taxation. They have different forms for different types of taxes.

- Double-Check Your Work: Mistakes can cost you time and money, so take a few extra minutes to review everything before submitting.

- Submit and Wait: Once you’ve filed, sit back and wait for confirmation or your refund, if applicable.

Pro tip: If you’re not confident in your ability to file on your own, consider hiring a tax professional. They can help ensure everything is done correctly and might even find you some extra deductions.

Common Mistakes to Avoid

Top Errors When Dealing with Virginia Taxes

Even the most careful filers can make mistakes. Here are some common errors to watch out for:

- Missing Deadlines: Failing to file or pay by the deadline can result in penalties and interest.

- Incorrect Information: Double-check all the numbers and personal details to avoid delays in processing.

- Forgetting Deductions: Don’t leave money on the table! Make sure you’re claiming all the deductions and credits you’re entitled to.

- Ignoring Notices: If you receive a notice from the Department of Taxation, don’t ignore it. Respond promptly to avoid bigger issues down the line.

Stay vigilant, and you’ll save yourself a lot of hassle in the long run.

Resources Available from the Virginia Department of Taxation

Where to Find Help and Information

The Virginia Department of Taxation offers a wealth of resources to help you navigate the tax system. Their website is a treasure trove of information, with guides, FAQs, and forms available for download. They also have a customer service team ready to assist you if you have questions or need clarification on something.

For those who prefer in-person assistance, the department has offices scattered throughout the state where you can visit and speak with a representative. Just be sure to check their hours and make an appointment if necessary.

Understanding Tax Deadlines in Virginia

Important Dates to Remember

Mark your calendars, folks. Here are some key deadlines to keep in mind:

- April 15: Individual income tax returns are due by this date.

- January 31: Employers must provide W-2 forms to employees by this date.

- Quarterly Filings: If you’re self-employed or a business owner, don’t forget about your quarterly estimated tax payments.

Missing these deadlines can result in penalties, so set reminders and stay organized.

Tips for Staying Compliant

How to Avoid Tax Troubles

Compliance is key when it comes to taxes. Here are a few tips to help you stay on the right side of the Virginia Department of Taxation:

- Keep Good Records: Maintain accurate and organized records of all your financial transactions.

- Stay Informed: Tax laws can change, so make it a habit to stay updated on any new regulations or requirements.

- Seek Professional Help if Needed: If you’re unsure about anything, don’t hesitate to consult a tax expert.

By following these tips, you’ll minimize the risk of running into trouble with the tax authorities.

Impact of Virginia Taxes on Residents and Businesses

How Taxes Affect Everyday Life

Taxes might seem like just a number on a form, but they have a real impact on your daily life. For residents, taxes affect everything from your take-home pay to the cost of goods and services. Businesses, on the other hand, have to factor in taxes when setting prices and planning budgets.

The Virginia Department of Taxation works hard to ensure that the tax system is fair and equitable. By collecting the necessary funds, they help support important state programs and services that benefit everyone.

Future Trends in Virginia Taxation

What’s on the Horizon?

As the world changes, so do tax laws. The Virginia Department of Taxation is constantly adapting to new challenges and opportunities. Expect to see more emphasis on digital filing, increased use of technology to streamline processes, and possibly even changes to tax rates and regulations.

Stay tuned for updates, and make sure you’re keeping up with any new developments that could affect your tax situation.

Conclusion

And there you have it, folks. The Virginia Department of Taxation might not be the most exciting topic, but it’s certainly one of the most important. By understanding how it works and what your responsibilities are, you can take control of your financial future and avoid any unnecessary headaches.

Remember, knowledge is power. Use the resources available to you, stay informed, and don’t hesitate to seek help if you need it. And hey, if you found this article helpful, why not share it with a friend? Or leave a comment below with your thoughts. Let’s keep the conversation going!

Table of Contents:

Virginia Department of Taxation: Your Ultimate Guide to Navigating State Taxes

Understanding the Virginia Department of Taxation

What Exactly is the Virginia Department of Taxation?

Key Responsibilities of the Department

Types of Taxes Managed by the Department

Individual Income Tax

Sales and Use Tax

How to File Your Taxes in Virginia

Steps to Filing Your State Taxes

Common Mistakes to Avoid

Top Errors When Dealing with Virginia Taxes

Resources Available from the Virginia Department of Taxation

Where to Find Help and Information

Understanding Tax Deadlines in Virginia

Important Dates to Remember

Tips for Staying Compliant

How to Avoid Tax Troubles

Impact of Virginia Taxes on Residents and Businesses

How Taxes Affect Everyday Life

Future Trends in Virginia Taxation

What’s on the Horizon?

Conclusion