So, here we are diving headfirst into the world of the State of Virginia Department of Taxation. Think of it like a treasure hunt where the treasure is understanding how your taxes work in Virginia. Now, whether you're a resident, a business owner, or just someone curious about the tax landscape in this beautiful state, you're in for a treat. The Department of Taxation plays a crucial role in shaping how Virginians manage their finances. And trust me, this ain't just about numbers; it's about your money, your life, and your future.

Virginia’s tax system is no walk in the park—it’s a labyrinth of rules, forms, and deadlines. But don’t worry, because we’re here to break it down for you in a way that’s as easy as pie. From understanding the basics to navigating the complexities, we’ve got all the answers you need. The Department of Taxation in Virginia isn’t just about collecting taxes; it’s about ensuring that every dollar is used wisely for the benefit of the state and its people.

Now, why should you care? Well, because taxes affect pretty much every aspect of your life. From buying a house to running a business, the State of Virginia Department of Taxation has its fingers in every pie. So, let’s roll up our sleeves and get into the nitty-gritty of what this department does, how it impacts you, and how you can make the most out of it. Without further ado, let’s dive in!

Read also:Bill Oreilly Education The Untold Story Of A Media Moguls Academic Journey

Understanding the Basics of Virginia Department of Taxation

Alright, let’s start with the basics. The Virginia Department of Taxation is like the brains behind the state’s financial operations. They’re the ones who collect taxes, enforce tax laws, and make sure everything runs smoothly. Think of them as the referees in the game of finance, making sure everyone plays by the rules. Their job is to ensure that the state has enough funds to keep things running, from building roads to funding schools.

Now, the department doesn’t just sit around waiting for people to pay their taxes. Oh no, they’re actively involved in educating the public about tax laws, offering resources to help people understand their obligations, and even providing assistance to those who need it. They’ve got a whole team of experts who are dedicated to making sure that the tax system is fair and efficient. So, if you ever feel lost in the maze of tax forms and regulations, they’re there to guide you through.

Key Functions of the Department

Let’s break down the key functions of the Virginia Department of Taxation. First up, they handle individual income taxes. That’s right, they’re the ones who make sure you’re paying your fair share of income tax. But it doesn’t stop there. They also deal with corporate taxes, sales taxes, and even excise taxes. Basically, if it involves money, they’re probably involved.

Another important function is enforcement. They’ve got a whole team of auditors who make sure that people aren’t dodging their tax responsibilities. And trust me, you don’t want to get on their bad side. But hey, they’re not all doom and gloom. They also offer programs to help people who are struggling to pay their taxes, like installment agreements and abatements. So, if you’re in a tough spot, they might be able to lend a hand.

Exploring the Different Types of Taxes in Virginia

Now that we’ve got the basics down, let’s talk about the different types of taxes in Virginia. First up, we’ve got the individual income tax. This is the tax that most people are familiar with. It’s based on how much money you make in a year. The more you earn, the more you pay. Simple, right? Well, not exactly. There are all sorts of deductions and credits that can affect how much you owe, so it’s important to stay informed.

Then there’s the corporate income tax. This one’s for all the business owners out there. If you’re running a company in Virginia, you’re gonna have to pay up. The rate varies depending on how much profit your business makes, but it’s usually around 6%. And don’t forget about sales tax. Whether you’re buying a coffee or a car, you’re gonna see that little extra charge at the register. Sales tax in Virginia is currently at 4.3%, but it can vary depending on where you are in the state.

Read also:Six Flags Hours California Your Ultimate Guide To Thrills And Adventures

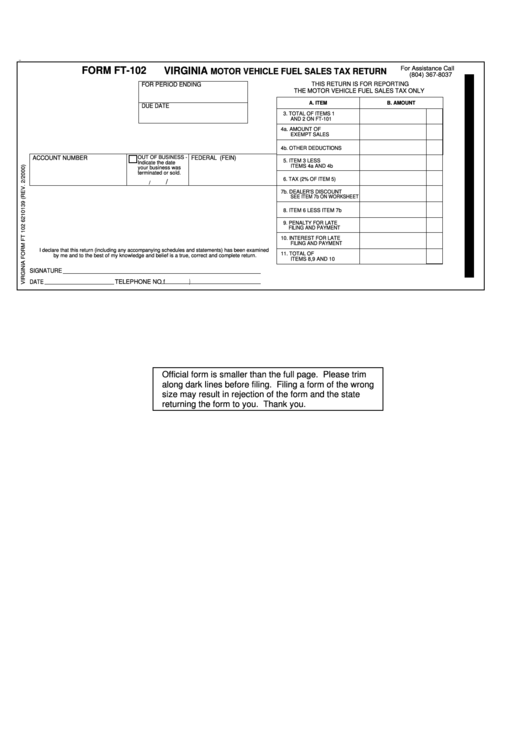

Excise Taxes and Other Fees

Let’s not forget about excise taxes. These are taxes on specific goods and services, like gasoline, cigarettes, and alcohol. They’re kind of like a hidden cost that you might not even notice until you’re at the pump or the checkout line. But hey, they’re there, and they’re adding up. And then there’s all sorts of other fees, like property taxes, vehicle registration fees, and even dog license fees. Yep, even your furry friend has to contribute to the state’s coffers.

It might seem overwhelming, but each of these taxes serves a purpose. They help fund everything from public schools to parks and recreation. So, while it might not be fun to pay them, it’s important to remember that they’re what keeps the state running smoothly.

How Does the Virginia Department of Taxation Impact You?

So, how exactly does the Virginia Department of Taxation impact you? Well, let’s start with the obvious. They’re the ones who make sure you’re paying your taxes. But it goes deeper than that. They’re also the ones who make sure that the money you pay in taxes is being used wisely. They oversee how the state spends its money, ensuring that it’s going towards things that benefit the public.

For individuals, this means better schools, safer roads, and more community programs. For businesses, it means a stable economy and a supportive environment to grow and thrive. The department also plays a crucial role in economic development, working with businesses to create jobs and stimulate growth. So, whether you’re a resident or a business owner, the Virginia Department of Taxation has a direct impact on your life.

Services Offered by the Department

Now, let’s talk about the services offered by the Virginia Department of Taxation. First up, they’ve got a ton of resources available online. From tax forms to calculators, they’ve got everything you need to file your taxes with ease. They also offer customer service, both online and over the phone, to help you with any questions or issues you might have.

For businesses, they’ve got specialized programs and services. They offer tax credits and incentives to encourage businesses to invest in the state. And if you’re struggling to pay your taxes, they’ve got payment plans and abatements to help you out. So, no matter who you are or what your situation is, the Virginia Department of Taxation has got something for you.

Understanding Tax Laws in Virginia

Alright, let’s talk about tax laws in Virginia. Now, tax laws can be a bit of a headache, but they’re essential to understanding how the system works. The Virginia Department of Taxation is responsible for enforcing these laws, making sure that everyone is playing by the rules. They’ve got a whole team of experts who are constantly updating and revising the laws to keep up with changes in the economy and society.

One of the key aspects of Virginia’s tax laws is the concept of residency. Depending on where you live and work, you might be considered a resident or a non-resident. This affects how much tax you owe and what deductions and credits you’re eligible for. And then there’s the whole issue of deductions and credits. These are basically ways to reduce the amount of tax you owe, and they can make a big difference in how much you end up paying.

Common Tax Deductions and Credits

Let’s take a look at some common tax deductions and credits in Virginia. First up, we’ve got the standard deduction. This is a set amount that everyone gets to deduct from their income, no questions asked. Then there’s the earned income tax credit, which is designed to help low to moderate-income individuals and families. And don’t forget about the child tax credit, which can save families with kids a significant amount of money.

There are also deductions for things like mortgage interest, charitable donations, and even education expenses. So, if you’re paying off a student loan or sending your kids to college, you might be eligible for some sweet tax breaks. And for businesses, there are all sorts of deductions and credits for things like research and development, hiring veterans, and investing in renewable energy. So, it pays to know what’s out there.

Dealing with Tax Issues in Virginia

Now, let’s talk about dealing with tax issues in Virginia. Whether you’ve made a mistake on your tax return or you’re having trouble paying your taxes, the Virginia Department of Taxation is there to help. They’ve got a whole team of experts who can assist you in resolving any issues you might have. But the key is to act quickly. The longer you wait, the more complicated things can get.

If you’ve made a mistake on your tax return, the first step is to file an amended return. This is basically a corrected version of your original return. And if you’re having trouble paying your taxes, don’t panic. The department offers payment plans and abatements to help you get back on track. Just remember, communication is key. If you’re upfront about your situation, they’re usually willing to work with you.

Appealing Tax Decisions

Now, let’s say you disagree with a tax decision made by the Virginia Department of Taxation. You’ve got the right to appeal, and they’ve got a process in place to handle these situations. The first step is to file a formal appeal, which involves submitting a written request and any supporting documentation. From there, they’ll review your case and make a decision.

It’s important to note that the appeals process can take some time, so patience is key. But if you’ve got a legitimate case, it’s definitely worth pursuing. And hey, if you’re not comfortable handling it on your own, you can always hire a tax professional to represent you. They’ve got the expertise and experience to navigate the system and get you the best possible outcome.

Tips for Filing Your Taxes in Virginia

Alright, let’s wrap things up with some tips for filing your taxes in Virginia. First and foremost, start early. The earlier you start, the more time you have to gather all the necessary documents and information. And don’t forget to double-check everything before you submit your return. Mistakes can cost you time and money, so it’s worth taking the extra few minutes to make sure everything’s in order.

Next up, take advantage of all the resources available to you. Whether it’s the Virginia Department of Taxation’s website or a local tax professional, there’s no shortage of help out there. And if you’re feeling overwhelmed, consider hiring a tax preparer. They can guide you through the process and make sure you’re getting all the deductions and credits you’re entitled to. Remember, it’s your money, so it pays to be thorough.

Common Mistakes to Avoid

Finally, let’s talk about some common mistakes to avoid. One of the biggest is missing the filing deadline. This can result in penalties and interest, so it’s crucial to get your return in on time. Another common mistake is not reporting all your income. Even if it’s from a side gig or freelance work, it needs to be reported. And don’t forget about those deductions and credits. Leaving money on the table is never a good idea.

So, there you have it. The State of Virginia Department of Taxation in a nutshell. It’s a complex system, but with the right information and resources, it’s something you can master. Whether you’re a resident, a business owner, or just someone curious about the tax landscape in Virginia, this guide has got you covered. Now go out there and conquer those taxes!

Conclusion: Taking Control of Your Taxes

Alright, we’ve covered a lot of ground here. From understanding the basics of the Virginia Department of Taxation to navigating the complexities of tax laws, you’re now armed with the knowledge to take control of your taxes. Remember, taxes don’t have to be scary. With the right approach and resources, they can be manageable and even beneficial.

So, what’s next? Well, why not take a moment to leave a comment or share this article with your friends? Knowledge is power, and the more people understand about taxes, the better off we all are. And hey, if you’ve got any questions or need further clarification, don’t hesitate to reach out. We’re here to help. Now go out there and make the most of your money, your life, and your future!

Table of Contents