Blue Cross Blue Shield (BCBS) plans are more than just health insurance; they're your lifeline to quality healthcare. Whether you're shopping for individual coverage or employer-sponsored insurance, BCBS offers a variety of plan types tailored to meet your needs. But here's the deal—navigating the world of health insurance can feel like decoding a foreign language. Don’t worry, we’ve got your back. In this guide, we’ll break down the ins and outs of BCBS plan types in a way that’s easy to digest, so you can make an informed decision.

Let’s face it, health insurance isn’t exactly a fun topic to dive into, but it’s one of those things you can’t afford to ignore. From understanding deductibles to figuring out provider networks, BCBS plan types offer flexibility and options that cater to different lifestyles and budgets. Whether you're young and healthy or have ongoing medical needs, finding the right plan is crucial for both your wallet and well-being.

Now, if you’re scratching your head wondering why Blue Cross Blue Shield even matters, here’s the lowdown. With over 100 million members nationwide, BCBS is one of the largest health insurance providers in the U.S. That means access to a vast network of doctors, hospitals, and specialists. So, whether you're in the city or out in the boonies, you’re covered. And who doesn’t love that kind of peace of mind?

Read also:Koa Campgrounds Gatlinburg Tn Your Ultimate Guide To Unforgettable Adventures

Table of Contents

- What is Blue Cross Blue Shield?

- Blue Cross Blue Shield Plan Types Explained

- HMO Plans: The Basics

- PPO Plans: What You Need to Know

- EPO Plans: A Middle Ground

- High-Deductible Plans: Are They Right for You?

- Understanding Provider Networks

- Breaking Down the Costs

- Eligibility Requirements

- Tips for Choosing the Right Plan

What is Blue Cross Blue Shield?

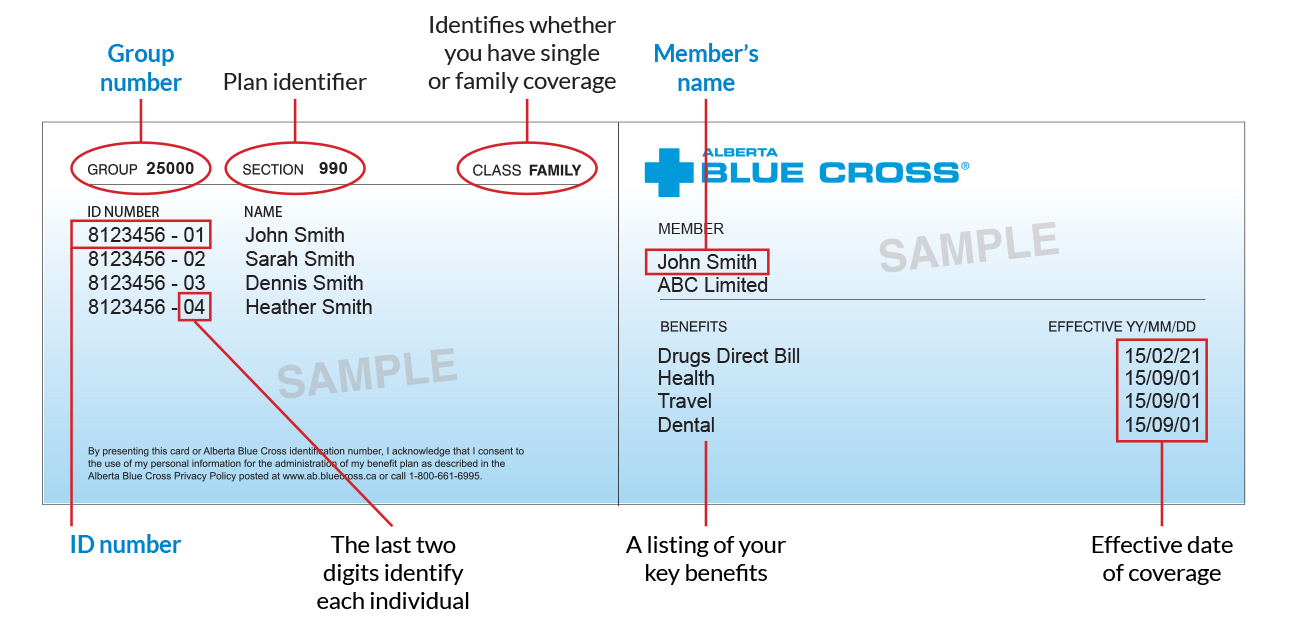

Before we dive into the plan types, let’s get the basics straight. Blue Cross Blue Shield is not just one company—it’s a federation of 36 independent health insurance organizations that operate under the same brand. Think of it as a big family with a shared mission: to provide affordable, high-quality healthcare coverage to everyone. BCBS has been around since the 1930s, making it one of the oldest and most trusted names in the insurance game.

One of the coolest things about BCBS is its nationwide network. Whether you’re traveling across the country or just visiting a specialist in the next town over, you’ll likely find a BCBS provider nearby. This extensive network ensures you’re covered no matter where life takes you. And hey, who doesn’t love that kind of flexibility?

Blue Cross Blue Shield Plan Types Explained

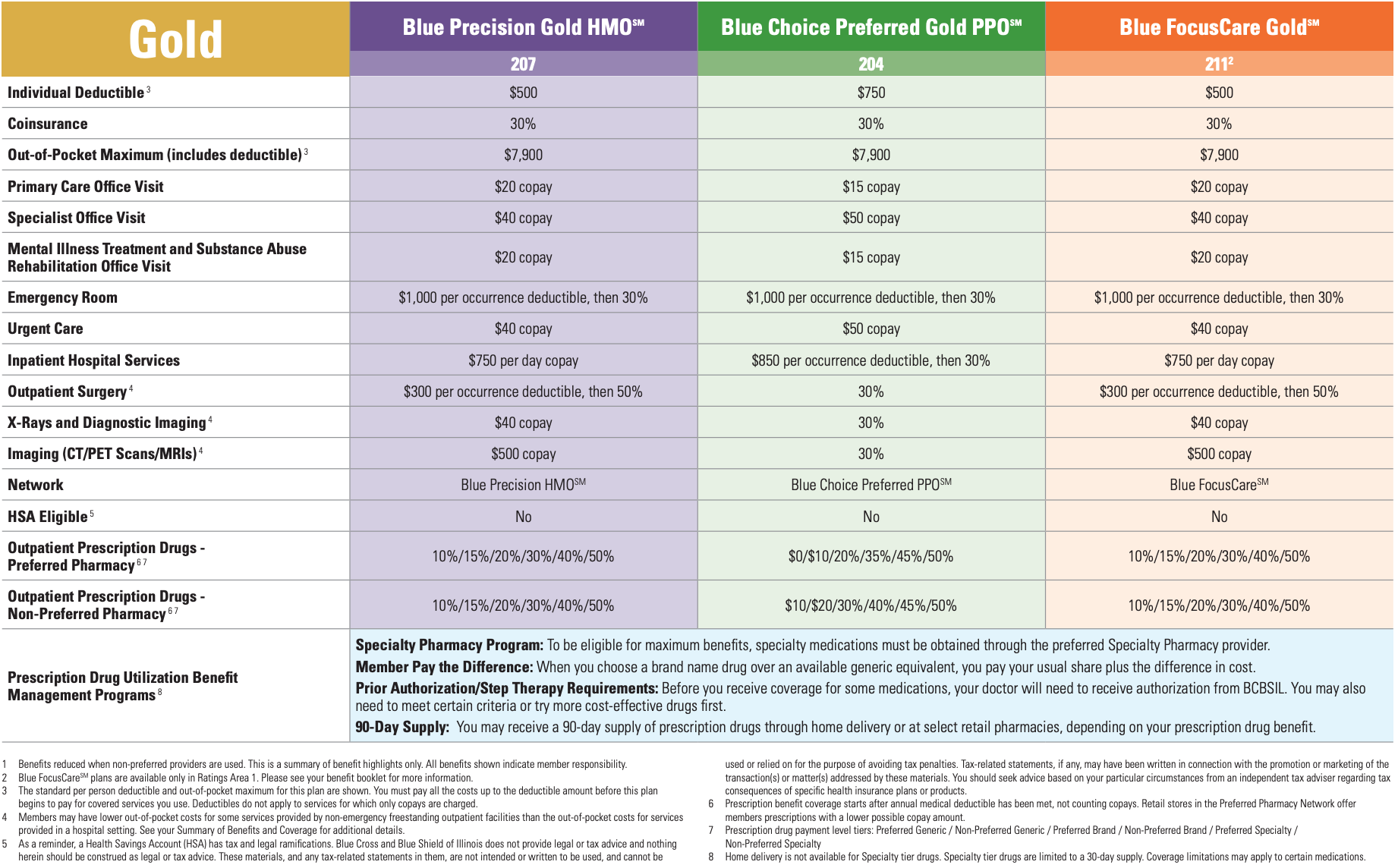

Now that you know what BCBS is all about, let’s talk about the different plan types they offer. Each plan comes with its own set of rules, costs, and benefits, so it’s important to understand them before signing up. Here’s a quick rundown:

- HMO Plans: These plans require you to choose a primary care physician (PCP) and get referrals for specialists.

- PPO Plans: Offer more flexibility with a wider network of providers, but usually come with higher premiums.

- EPO Plans: A mix of HMO and PPO plans, offering a balance between cost and convenience.

- High-Deductible Plans: Great for people who don’t expect many medical expenses, but come with lower premiums.

HMO Plans: The Basics

HMO stands for Health Maintenance Organization, and it’s one of the most popular BCBS plan types. With an HMO plan, you’ll need to choose a primary care physician (PCP) who will coordinate all your healthcare needs. If you need to see a specialist, you’ll need a referral from your PCP. While this might sound restrictive, HMO plans often come with lower premiums and out-of-pocket costs, making them a great option for people who don’t mind sticking to a specific network.

Here’s the kicker: HMO plans usually have limited coverage outside their network. So, if you travel a lot or prefer seeing specialists without a referral, this might not be the best choice for you. But hey, if you’re all about keeping things simple and saving money, HMO plans are definitely worth considering.

PPO Plans: What You Need to Know

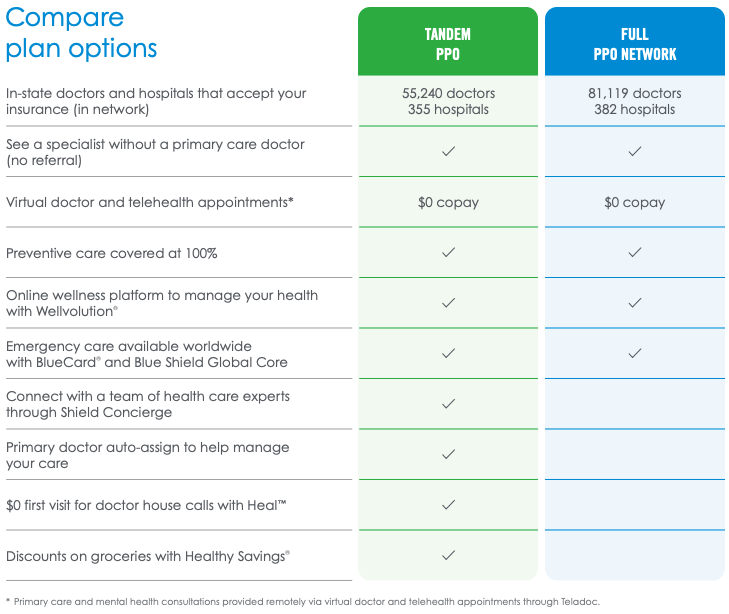

PPO stands for Preferred Provider Organization, and it’s the go-to plan for people who value flexibility. Unlike HMO plans, PPOs allow you to see specialists without a referral and offer coverage both in and out of network. Sure, you’ll pay more for out-of-network care, but having that option can be a lifesaver in certain situations.

Read also:Spencer Cassadine The Enigmatic Soap Opera Star You Cant Stop Talking About

PPO plans tend to come with higher premiums than HMOs, but they also offer more comprehensive coverage. If you have ongoing medical needs or prefer having more control over your healthcare choices, a PPO plan might be the way to go. Just remember, with great flexibility comes great responsibility—and a bigger bill.

EPO Plans: A Middle Ground

Think of EPO plans as the Goldilocks of health insurance—not too restrictive, not too expensive, just right. EPO stands for Exclusive Provider Organization, and it combines the best features of HMO and PPO plans. Like HMOs, EPO plans require you to stay within their network to get full coverage, but unlike HMOs, you don’t need a referral to see a specialist.

EPO plans strike a balance between cost and convenience, making them a great option for people who want the flexibility of a PPO without the higher premiums. If you’re looking for a plan that’s easy to manage and budget-friendly, EPO might be the perfect fit for you.

High-Deductible Plans: Are They Right for You?

If you’re the type of person who rarely visits the doctor, a high-deductible health plan (HDHP) could save you a ton of money. HDHPs come with lower premiums, but you’ll have to pay more out of pocket before your insurance kicks in. This makes them ideal for young, healthy individuals who don’t expect many medical expenses.

One of the perks of HDHPs is that they’re often paired with health savings accounts (HSAs), which allow you to set aside pre-tax dollars for medical expenses. This can be a great way to build up a financial safety net for unexpected healthcare costs. However, if you have chronic conditions or anticipate needing frequent medical care, an HDHP might not be the best choice.

Understanding Provider Networks

When it comes to BCBS plans, understanding provider networks is key. A provider network is essentially a group of doctors, hospitals, and other healthcare providers that have agreed to offer services at negotiated rates. Staying within your network can save you a lot of money, so it’s important to check if your preferred doctors and hospitals are included.

Most BCBS plans offer access to a large network of providers, but the specifics can vary depending on your plan type. HMOs and EPOs typically have more limited networks, while PPOs offer broader coverage. Before choosing a plan, make sure to review the provider directory to ensure your favorite docs are covered.

Why Network Size Matters

Here’s the deal: the size of your provider network can have a big impact on your healthcare experience. A larger network gives you more options when it comes to choosing doctors and hospitals, which can be especially important if you have specific healthcare needs. On the flip side, smaller networks can lead to lower premiums and out-of-pocket costs, but you’ll have fewer choices.

When evaluating BCBS plan types, consider how much flexibility you need and whether you’re willing to trade convenience for cost savings. It’s all about finding the right balance for your unique situation.

Breaking Down the Costs

Let’s talk numbers, shall we? When comparing BCBS plan types, it’s important to consider all the costs involved, not just the premiums. Here’s a quick breakdown:

- Premiums: The amount you pay monthly for your insurance coverage.

- Deductibles: The amount you pay out of pocket before your insurance starts covering costs.

- Copayments: A fixed amount you pay for certain services, like doctor visits or prescription drugs.

- Coincidence: The percentage of costs you’re responsible for after your deductible is met.

Keep in mind that these costs can vary widely depending on your plan type and coverage level. For example, HMO plans often have lower premiums and deductibles, but higher copayments. PPO plans, on the other hand, might have higher premiums but lower out-of-pocket costs overall. It’s all about weighing the pros and cons to find the best value for your money.

Eligibility Requirements

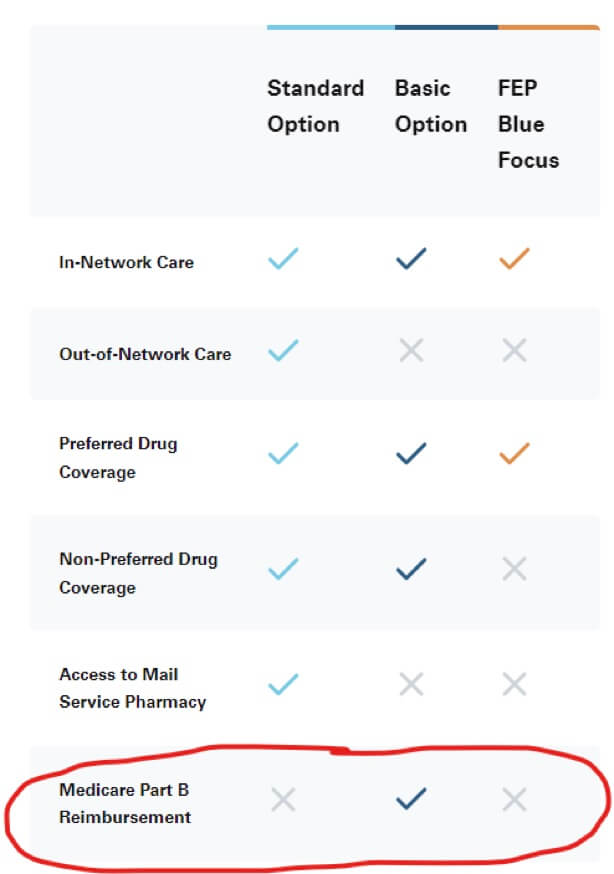

Not everyone is eligible for BCBS plans, so it’s important to know the rules. Most BCBS plans are available through employers, but you can also purchase individual coverage through the Health Insurance Marketplace. If you’re self-employed or don’t have access to employer-sponsored insurance, BCBS offers a variety of options to fit your needs.

Some plans may have income or residency requirements, so be sure to check the details before applying. Additionally, certain pre-existing conditions might affect your eligibility or coverage options. If you’re unsure about your eligibility, don’t hesitate to reach out to a BCBS representative for guidance.

Tips for Choosing the Right Plan

Picking the right BCBS plan can feel overwhelming, but it doesn’t have to be. Here are a few tips to help you make the best decision:

- Assess Your Needs: Consider your current health status and anticipated medical expenses for the year.

- Review Costs: Compare premiums, deductibles, copayments, and coinsurance to find the best value.

- Check Provider Networks: Ensure your preferred doctors and hospitals are included in the network.

- Read the Fine Print: Don’t overlook important details like coverage limits and exclusions.

- Ask for Help: If you’re unsure, consult with a BCBS representative or licensed insurance agent.

Remember, there’s no one-size-fits-all solution when it comes to health insurance. The right plan for you depends on your unique circumstances, so take the time to evaluate your options carefully.

Kesimpulan

Blue Cross Blue Shield plan types offer a wide range of options to suit different lifestyles and budgets. From HMOs and PPOs to EPOs and high-deductible plans, there’s something for everyone. By understanding the features and costs of each plan type, you can make an informed decision that aligns with your healthcare needs and financial goals.

So, whether you’re shopping for individual coverage or employer-sponsored insurance, take the time to explore your options and choose wisely. And hey, don’t forget to leave a comment or share this article if you found it helpful. Your feedback means a lot to us, and it helps others find the information they need. Stay healthy, and happy hunting for the perfect BCBS plan!