Hey there, fellow taxpayers! Are you ready to dive into the world of the VA State Department of Taxation? If you're living in Virginia or just want to get the scoop on how this department operates, you're in the right place. Whether you're filing your first tax return or just trying to make sense of the system, this guide has got your back. So, buckle up and let's get started!

Now, let’s be honest—taxes can be a headache. But the VA State Department of Taxation doesn’t have to be a mystery. In this article, we'll break it down for you in a way that’s easy to understand, so you can navigate the system with confidence. Think of it as your cheat sheet to mastering Virginia's tax game.

From understanding the basics of state taxes to navigating the complexities of deductions and credits, we’ve got all the info you need. Stick around, and by the end of this, you’ll be a VA tax guru!

Read also:Atampt Internet Customer Service Number Your Ultimate Guide To Seamless Connectivity

Understanding the VA State Department of Taxation

First things first, what exactly is the VA State Department of Taxation? It’s like the tax police of Virginia, but don’t worry—they’re here to help, not just to collect money. This department is responsible for collecting state taxes, enforcing tax laws, and ensuring that everyone pays their fair share. It’s a big job, but they do it with precision.

One of the coolest things about the VA State Department of Taxation is their commitment to transparency. They provide resources and tools to make the tax process as smooth as possible. Whether you're a business owner or an individual filer, they’ve got something for everyone.

Key Functions of the VA State Department of Taxation

- Collecting individual and corporate income taxes

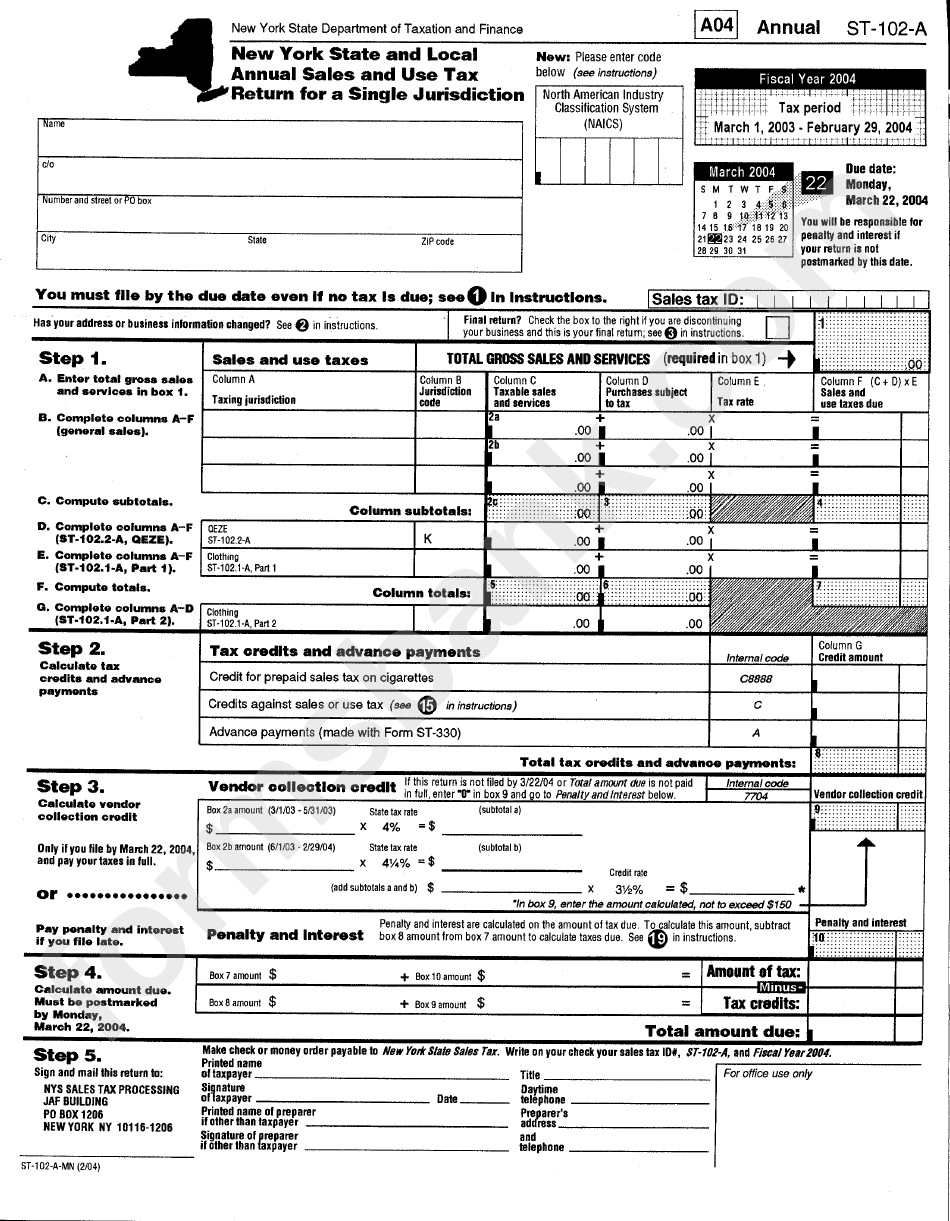

- Administering sales and use taxes

- Managing excise taxes

- Handling property taxes

These functions ensure that Virginia runs smoothly and efficiently. Without them, the state wouldn’t have the funds it needs to provide essential services like education, healthcare, and infrastructure. So, while paying taxes might not be your favorite activity, it’s definitely important.

VA State Department of Taxation: A Brief History

Let’s take a quick trip down memory lane. The VA State Department of Taxation has been around for a while, evolving over the years to meet the changing needs of Virginia’s residents. Established way back when, this department has grown into a powerhouse of tax administration.

Over the decades, they’ve introduced new systems and technologies to make the tax process easier for everyone. From paper filing to online submissions, they’ve embraced innovation to keep up with the times. And let’s not forget the role they played during economic booms and busts, always finding ways to support the state’s financial health.

Major Milestones in the Department’s History

- Introduction of electronic filing in the 1990s

- Expansion of online services in the 2000s

- Implementation of mobile apps in the 2010s

These milestones highlight the department’s dedication to staying ahead of the curve. They’ve consistently adapted to new technologies, making life easier for taxpayers like you and me.

Read also:Walnut Creek Movies The Ultimate Guide To Catching The Best Films In Town

How the VA State Department of Taxation Works

Now that we know what they do and where they came from, let’s talk about how they actually work. The VA State Department of Taxation operates through a network of offices and online platforms, ensuring that taxpayers have multiple ways to interact with them.

Whether you need to file a tax return, request a refund, or resolve an issue, the department has systems in place to handle it all. They employ a team of experts who are trained to assist with every aspect of the tax process, from basic inquiries to complex disputes.

Steps in the Tax Process

- Gather all necessary documents and information

- Complete the appropriate tax forms

- Submit your return through the preferred method

- Monitor the status of your submission

- Address any follow-up questions or issues

Following these steps can help you avoid common pitfalls and ensure a smooth tax experience. Plus, the VA State Department of Taxation offers plenty of resources to guide you along the way.

Taxpayer Resources: Your Go-To Tools

Speaking of resources, the VA State Department of Taxation has a treasure trove of tools at your disposal. From online calculators to detailed guides, they’ve got everything you need to make informed decisions about your taxes.

One of the best resources is their website, which is packed with information on everything from filing deadlines to tax credits. You can also find contact information for their customer service team, so you’re never left in the dark.

Top Resources for VA Taxpayers

- Online tax calculator

- Interactive tax guides

- Customer service hotline

- Mobile app for easy access

These resources are designed to make your life easier, so don’t hesitate to take advantage of them. They can save you time, money, and a lot of stress when tax season rolls around.

Common Tax Issues and How to Resolve Them

Let’s face it—taxes can be tricky, and problems can pop up at any time. Whether it’s a missing document or a misunderstood regulation, the VA State Department of Taxation is here to help you navigate these challenges.

One of the most common issues is missing deadlines. If this happens to you, don’t panic. The department offers extensions and penalties can often be waived if you act quickly. Another common problem is miscalculations, which can usually be fixed with a simple amendment to your return.

Tips for Avoiding Tax Problems

- Keep all your documents organized

- Double-check your calculations before filing

- Stay informed about changes in tax laws

- Seek professional advice if needed

By following these tips, you can minimize the chances of running into issues and ensure a stress-free tax experience.

Understanding VA State Tax Laws

Now let’s talk about the laws that govern the VA State Department of Taxation. These laws are what keep everything running smoothly and ensure that everyone is treated fairly. From income tax rates to sales tax percentages, there’s a lot to know.

One of the most important things to understand is the difference between state and federal taxes. While the federal government sets broad guidelines, each state has its own specific laws and regulations. In Virginia, the state tax laws are designed to reflect the unique needs and priorities of the Commonwealth.

Key Aspects of VA State Tax Laws

- Income tax brackets and rates

- Sales tax exemptions and reductions

- Property tax assessments

Understanding these aspects can help you make the most of your tax situation and take advantage of any available benefits or deductions.

VA State Department of Taxation: FAQs

Got questions? We’ve got answers. Here are some of the most frequently asked questions about the VA State Department of Taxation.

What Are the Filing Deadlines?

The filing deadlines for Virginia taxes typically align with federal deadlines, but it’s always a good idea to double-check. You can find the exact dates on the department’s website or by contacting their customer service team.

How Can I File My Taxes?

You can file your taxes online through the VA State Department of Taxation’s website or by mailing in your completed forms. Both methods are secure and reliable, so choose the one that works best for you.

What Happens If I Miss a Deadline?

If you miss a deadline, don’t worry—you can usually request an extension. Just be sure to act quickly, as penalties can add up if you wait too long.

Why the VA State Department of Taxation Matters

Finally, let’s talk about why the VA State Department of Taxation is so important. This department plays a crucial role in the financial health of Virginia, ensuring that funds are collected and allocated efficiently. Without them, the state wouldn’t be able to provide the services and infrastructure that make Virginia such a great place to live.

By understanding how the department works and taking advantage of the resources they offer, you can become a more informed and empowered taxpayer. And who knows? You might even start to enjoy the tax process—well, almost.

Take Action Today

So, what are you waiting for? Dive into the world of the VA State Department of Taxation and take control of your tax situation. Whether you’re filing your first return or just looking to learn more, this guide has everything you need to succeed.

Conclusion

And there you have it—a comprehensive guide to the VA State Department of Taxation. From understanding the basics to navigating the complexities, we’ve covered it all. Remember, taxes don’t have to be scary. With the right tools and knowledge, you can tackle them with confidence.

Now it’s your turn. Share this article with your friends and family, leave a comment below, or check out some of our other articles for more tax tips and tricks. Let’s make tax season a little less stressful, one step at a time!

Table of Contents

- Understanding the VA State Department of Taxation

- VA State Department of Taxation: A Brief History

- Key Functions of the VA State Department of Taxation

- How the VA State Department of Taxation Works

- Steps in the Tax Process

- Taxpayer Resources: Your Go-To Tools

- Common Tax Issues and How to Resolve Them

- Tips for Avoiding Tax Problems

- Understanding VA State Tax Laws

- Key Aspects of VA State Tax Laws

- VA State Department of Taxation: FAQs

- Why the VA State Department of Taxation Matters

- Take Action Today