Let’s face it, folks, taxes are one of those things that nobody really enjoys, but they’re a necessary part of life. If you live in the Commonwealth of Virginia, understanding the ins and outs of the Department of Taxation is crucial for staying compliant and avoiding headaches. Whether you’re a resident, business owner, or just someone curious about how it all works, this guide has got your back. We’ll dive deep into everything you need to know about the Commonwealth of Virginia Department of Taxation, breaking it down in a way that’s easy to understand.

Now, before we get into the nitty-gritty, let’s talk about why this matters. Taxes might seem like a boring topic, but they have a massive impact on your wallet, your business, and even your community. The Department of Taxation in Virginia handles everything from personal income tax to sales tax, so knowing how it operates can save you time, money, and stress. Think of it as the ultimate cheat sheet for navigating the tax world in Virginia.

So, buckle up because we’re about to break it all down for you. From understanding tax rates to figuring out deadlines and even uncovering some hidden gems like tax credits, this article is packed with info you won’t want to miss. Let’s make taxes a little less scary, shall we?

Read also:What Happened To Michael Jacksons Skin Unveiling The Truth Behind The Iconic Transformation

What is the Commonwealth of Virginia Department of Taxation?

Alright, let’s start with the basics. The Commonwealth of Virginia Department of Taxation is essentially the state agency responsible for administering Virginia’s tax laws. It’s like the brains behind the operation, ensuring that everyone pays their fair share while also helping taxpayers understand their obligations. Think of it as the middleman between you and the government when it comes to taxes.

Here’s the deal: the Department oversees a wide range of taxes, including individual income tax, corporate income tax, sales and use tax, fuel tax, and more. They’re also the ones who issue tax forms, process returns, and handle any issues or disputes that might pop up. In short, they’re the go-to authority on all things tax-related in Virginia.

But why does this matter to you? Well, if you’re a resident of Virginia, you’re subject to the state’s tax laws, and the Department of Taxation is the entity that enforces those laws. Understanding how it works can help you avoid penalties, take advantage of deductions, and make sure you’re meeting all your tax obligations.

Key Responsibilities of the Department

Tax Collection

One of the main jobs of the Commonwealth of Virginia Department of Taxation is collecting taxes. This includes everything from individual income tax to business taxes and even excise taxes on things like alcohol and tobacco. They’re the ones who make sure the state gets its slice of the pie, so to speak.

Now, here’s an interesting fact: Virginia uses a progressive tax system, meaning that the more you earn, the higher the tax rate you pay. For example, in 2023, the tax rates ranged from 2% for lower-income brackets to 5.75% for higher-income brackets. It’s important to note that these rates can change, so staying informed is key.

Enforcement of Tax Laws

Another big responsibility of the Department is enforcing tax laws. This involves auditing taxpayers, investigating potential fraud, and ensuring compliance. If you’ve ever heard the term “tax audit,” this is where it comes from. The Department has the power to review your tax returns and ask for documentation to verify your claims.

Read also:Why Amc Theatre At Parks Mall Is Your Ultimate Movie Destination

Don’t worry, though. Audits aren’t as scary as they sound. In most cases, they’re just a routine check to ensure everything is on the up and up. However, if you’ve made any errors or failed to report income, you might face penalties. That’s why it’s always a good idea to keep accurate records and file your taxes correctly.

Understanding Virginia’s Tax Rates

Personal Income Tax

When it comes to personal income tax, Virginia follows a relatively straightforward system. As I mentioned earlier, the state uses a progressive tax structure, which means that different portions of your income are taxed at different rates. Here’s a quick breakdown:

- 2% on income up to $3,000

- 3% on income between $3,001 and $5,000

- 5% on income between $5,001 and $17,000

- 5.75% on income over $17,000

It’s worth noting that Virginia allows residents to deduct their federal income tax payments from their state taxable income. This can be a significant benefit, especially for those in higher tax brackets.

Sales and Use Tax

Virginia also imposes a sales tax on most goods and services. As of 2023, the standard sales tax rate is 4.3%, but some localities may add additional taxes, bringing the total rate up to 6% or more. This means that when you’re shopping, you’ll likely pay a little extra at the register.

Now, here’s a tip: some items are exempt from sales tax, such as groceries and prescription medications. So, if you’re ever wondering why your groceries don’t have tax added, that’s why. Always good to know, right?

Filing Your Taxes in Virginia

Deadlines and Forms

Alright, let’s talk about filing your taxes. In Virginia, the deadline for filing your state income tax return is typically April 15th, the same as the federal deadline. However, if you need more time, you can request an extension by submitting Form VA-4868. Just remember, an extension to file doesn’t mean an extension to pay any taxes you owe.

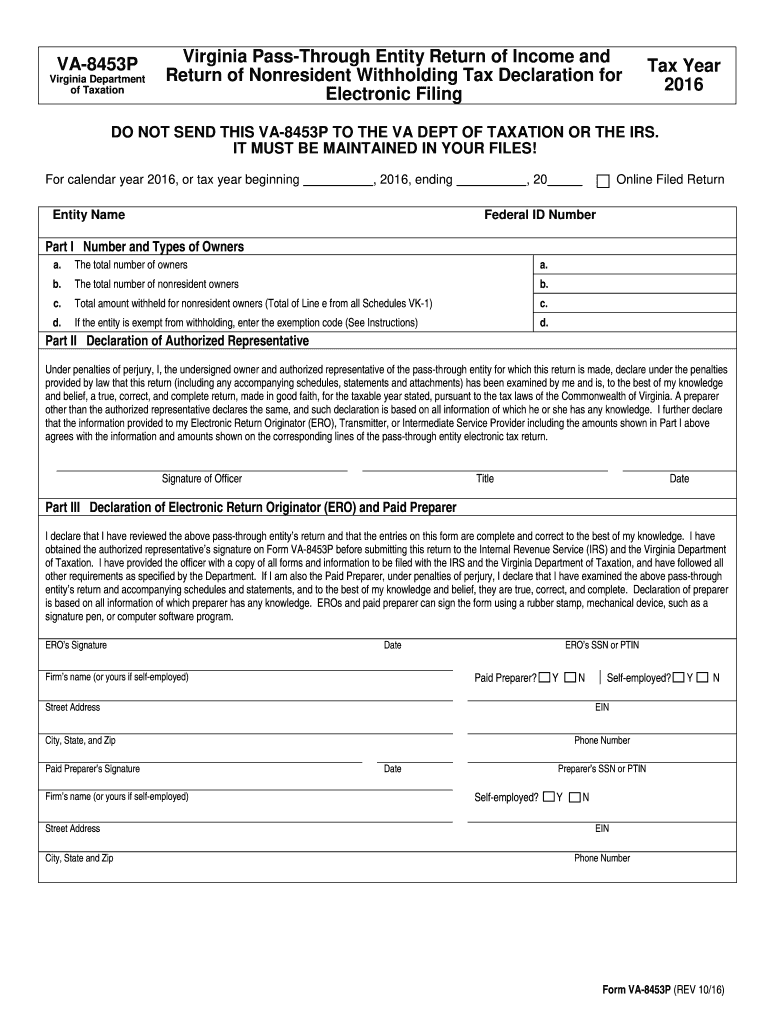

When it comes to forms, the Commonwealth of Virginia Department of Taxation provides a variety of options depending on your situation. For example, if you’re a single filer with no dependents, you might use Form 760. If you’re married filing jointly, you’d use Form 760P. The Department’s website has a full list of forms and instructions, so it’s worth checking out if you’re unsure which one to use.

Electronic Filing Options

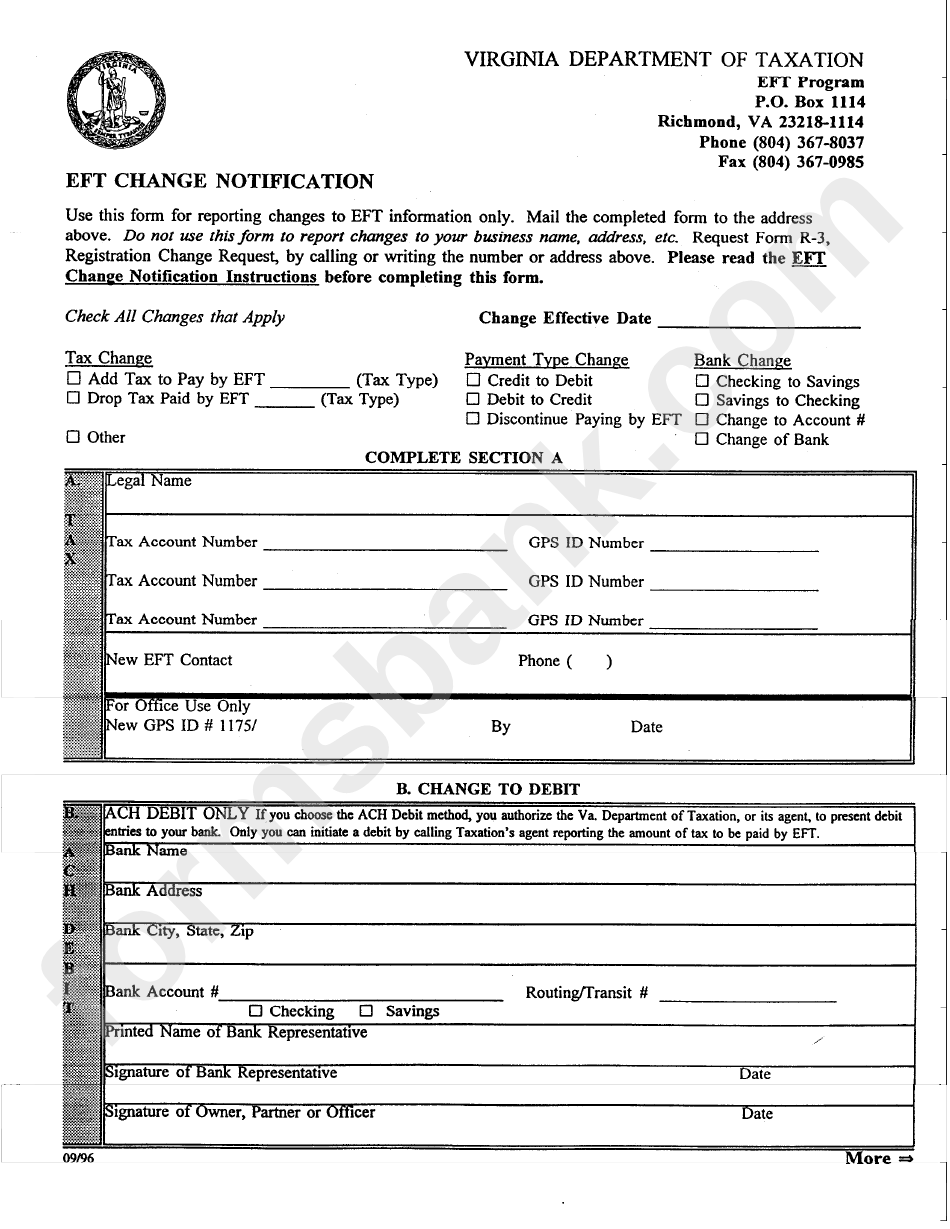

In this digital age, electronic filing has become the norm for many taxpayers. The Commonwealth of Virginia Department of Taxation offers several options for e-filing, including through their own system or via third-party providers. E-filing is not only faster and more convenient, but it also reduces the risk of errors since the software does most of the calculations for you.

Plus, if you’re due a refund, e-filing can get that money into your bank account much quicker than mailing in a paper return. Who doesn’t love getting their money faster, am I right?

Common Tax Credits and Deductions in Virginia

Virginia Education Tax Credit

One of the more popular tax credits in Virginia is the Education Tax Credit. This credit is available to individuals and businesses that contribute to qualifying scholarship organizations. It’s a great way to support education while also reducing your tax liability.

Here’s how it works: for every dollar you contribute, you can receive a 65% credit against your Virginia tax liability. So, if you donate $1,000, you could get a $650 credit. Not too shabby, right?

Property Tax Deduction

Another important deduction to consider is the property tax deduction. If you own a home in Virginia, you can deduct the property taxes you pay on your federal return. This can be a significant savings, especially if you live in an area with high property taxes.

Just remember, there are limits to how much you can deduct, so it’s always a good idea to consult with a tax professional if you’re unsure. Trust me, they’re worth their weight in gold when it comes to navigating the tax code.

Dealing with Tax Issues

Audits and Appeals

Let’s talk about audits for a moment. If you’ve been selected for an audit, don’t panic. The first thing you should do is gather all your records and documentation. The Department will let you know what they need, and it’s important to respond promptly.

If you disagree with the findings of an audit, you have the right to appeal. The process involves submitting a written request for an appeal and providing any additional evidence you have. It can be a bit of a hassle, but it’s worth it if you believe the audit was incorrect.

Penalties and Interest

Now, if you’ve made a mistake on your tax return or failed to file on time, you might face penalties and interest. The Department of Taxation assesses these based on the severity of the issue. For example, if you file late, you could face a penalty of 5% of the unpaid tax for each month your return is late, up to a maximum of 25%.

Interest is also charged on any unpaid taxes, so it’s always best to file and pay on time. If you’re having trouble paying, the Department offers installment agreements, which allow you to pay your taxes over time. Just be sure to set up the agreement before any penalties or interest accrue.

Tips for Staying Tax-Compliant

Keep Accurate Records

One of the best ways to stay tax-compliant is to keep accurate records. This includes keeping track of all your income, expenses, and deductions throughout the year. Whether you use a spreadsheet, accounting software, or even just a shoebox (not recommended), having everything organized makes tax time much easier.

Pro tip: set aside a little time each month to review your finances and update your records. It’s much easier to stay on top of things than to try and catch up at the last minute.

Stay Informed

Tax laws can change from year to year, so it’s important to stay informed. The Commonwealth of Virginia Department of Taxation frequently updates their website with the latest information, so it’s a good idea to check in regularly. You can also sign up for their newsletter to get updates delivered straight to your inbox.

And let’s not forget about consulting with a tax professional. If you’re unsure about anything, it’s always better to ask for help than to make a costly mistake. Trust me, your wallet will thank you in the long run.

Conclusion

So there you have it, folks. The Commonwealth of Virginia Department of Taxation might not be the most exciting topic, but it’s certainly an important one. By understanding how it works and staying informed, you can make sure you’re meeting all your tax obligations while also taking advantage of any available credits and deductions.

Remember, taxes don’t have to be scary. With a little preparation and the right resources, you can navigate the tax world with confidence. And if you ever have questions or run into issues, don’t hesitate to reach out to the Department or consult with a tax professional.

Now, it’s your turn. Did we miss anything important? Do you have any tips or tricks for staying tax-compliant in Virginia? Let us know in the comments below. And if you found this article helpful, be sure to share it with your friends and family. After all, knowledge is power, especially when it comes to taxes.

Table of Contents