Let’s talk about something big in the crypto world—crypto halving. If you’ve been paying attention to fintechzoom.com or any other crypto platforms, you might’ve heard whispers about this event. It’s not just another buzzword; it’s a game-changer for the crypto market. So, buckle up because we’re diving deep into what crypto halving means, why it matters, and how it impacts you as an investor or enthusiast.

Imagine this: every four years or so, the rewards for mining Bitcoin or other cryptocurrencies get cut in half. Crazy, right? But that’s exactly what happens during a crypto halving. This event is designed to control the supply of new coins entering circulation, creating scarcity and potentially driving up prices. It’s like a digital version of supply and demand, but with a twist.

Now, before we go any further, let’s set the stage. Whether you’re a seasoned crypto vet or just dipping your toes into the blockchain waters, understanding crypto halving is crucial. It’s one of those pivotal moments that can shape the future of digital currencies. So, grab your favorite drink, and let’s explore this fascinating phenomenon together.

Read also:Is Hillary Farr Married The Inside Scoop On Her Love Life And Career

What is Crypto Halving Anyway?

Alright, let’s break it down. Crypto halving refers to the process where the rewards for mining new blocks in a blockchain network are reduced by half. This mechanism is hard-coded into the protocol of many cryptocurrencies, including Bitcoin, the granddaddy of them all. Think of it as a built-in timer that ensures the currency doesn’t flood the market.

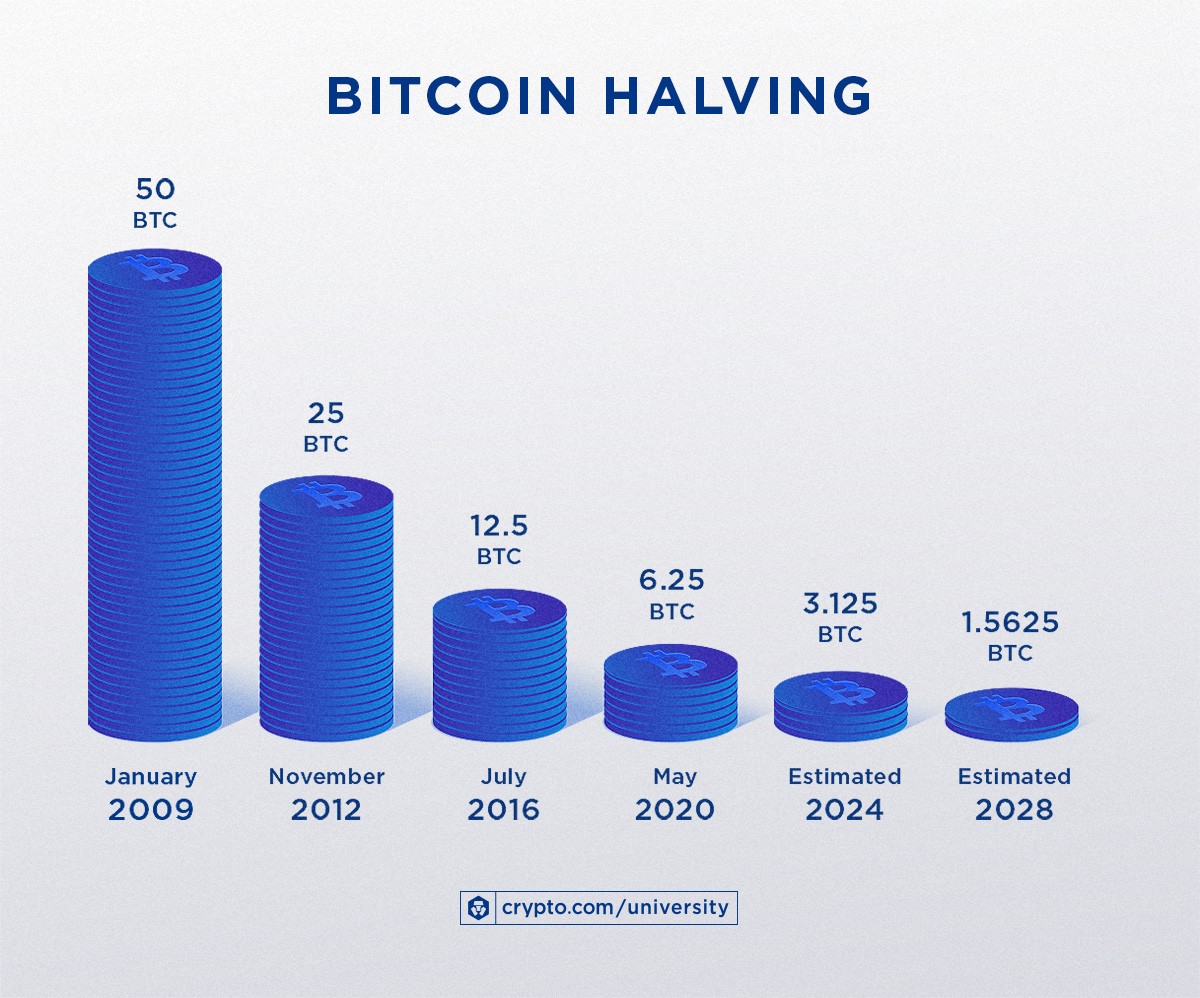

Here’s how it works: miners are rewarded with new coins for verifying transactions and adding them to the blockchain. But every 210,000 blocks—or roughly every four years in Bitcoin’s case—the reward gets slashed in half. So, if miners were getting 12.5 Bitcoins per block, after the halving, they’ll only get 6.25. Simple, yet powerful.

Why Does Crypto Halving Matter?

Now, you might be wondering, “Why should I care about this?” Well, crypto halving matters because it directly affects the supply and demand dynamics of cryptocurrencies. By reducing the supply of new coins, halving events can lead to increased scarcity, which often translates to higher prices. It’s a fundamental economic principle that plays out in the digital realm.

Historically, we’ve seen significant price surges following Bitcoin halving events. For instance, after the 2012 halving, Bitcoin skyrocketed from around $12 to over $1,000 by the end of 2013. Similarly, the 2016 halving paved the way for the epic bull run of 2017, where Bitcoin reached an all-time high of nearly $20,000. These are not just numbers; they’re potential opportunities for investors.

The History of Crypto Halving Events

Let’s take a trip down memory lane and revisit the major crypto halving events that have shaped the market so far. Understanding the past can give us valuable insights into what might happen in the future.

Bitcoin’s First Halving: 2012

Back in November 2012, Bitcoin experienced its very first halving event. The block reward dropped from 50 BTC to 25 BTC per block. At the time, Bitcoin was still relatively unknown, trading at around $12. But within a year, the price surged to over $1,000, marking the beginning of Bitcoin’s rise to prominence.

Read also:Top Picks For The Best Iot Devices To Transform Your Smart Home

Second Halving: 2016

Fast forward to July 2016, Bitcoin underwent its second halving. The block reward was halved again, this time from 25 BTC to 12.5 BTC. This event set the stage for the 2017 bull run, where Bitcoin reached its peak of almost $20,000. It was a rollercoaster ride that captured the world’s attention.

How Does Crypto Halving Impact Miners?

Now, let’s shift our focus to the miners, the backbone of the crypto ecosystem. For them, crypto halving is a double-edged sword. On one hand, it reduces their income as the block rewards get cut in half. On the other hand, the potential price increase following a halving can offset these losses, making it a win-win situation if the market behaves as expected.

However, not all miners are created equal. Those with outdated equipment or high electricity costs might struggle to stay profitable after a halving. This often leads to a consolidation in the mining industry, where only the most efficient and well-funded miners survive. It’s a Darwinian process that ensures the network remains robust and secure.

The Role of Fintechzoom.com in Crypto Halving

Enter fintechzoom.com, a platform that keeps you informed about all things crypto, including halving events. Whether you’re a newbie or a seasoned trader, fintechzoom.com provides valuable insights and analysis to help you navigate the ever-changing crypto landscape.

Through its comprehensive coverage, fintechzoom.com ensures that you’re always in the loop about upcoming halving events and their potential impact on the market. It’s like having a personal crypto advisor at your fingertips, keeping you ahead of the curve.

Predicting the Future: What’s Next for Crypto Halving?

So, what does the future hold for crypto halving? While we can’t predict the exact outcome, historical trends suggest that halving events often lead to price increases. However, it’s important to remember that the crypto market is volatile and influenced by numerous factors beyond just halving.

As we approach the next Bitcoin halving in 2024, all eyes will be on the market to see how it reacts. Will we witness another epic bull run, or will this time be different? Only time will tell, but one thing’s for sure: crypto halving will continue to be a defining feature of the digital currency landscape.

Factors Influencing Post-Halving Price Movements

Besides the halving itself, several other factors can influence post-halving price movements. These include macroeconomic conditions, regulatory developments, and overall market sentiment. For instance, if global economic uncertainty persists, investors might flock to Bitcoin as a safe-haven asset, driving up its price regardless of the halving.

Similarly, positive regulatory news or widespread adoption of cryptocurrencies could also contribute to price increases. On the flip side, negative headlines or regulatory crackdowns could dampen the market’s enthusiasm, potentially offsetting the effects of the halving.

Long-Term Implications of Crypto Halving

Beyond the immediate price impact, crypto halving has long-term implications for the sustainability and adoption of cryptocurrencies. By reducing the supply of new coins, halving events encourage holders to HODL (hold on for dear life) rather than sell, creating a more stable and mature market.

Moreover, as the block rewards diminish over time, transaction fees are expected to become a more significant source of income for miners. This transition will test the resilience and adaptability of the crypto ecosystem, ensuring its longevity and relevance in the years to come.

How Can You Prepare for the Next Crypto Halving?

Whether you’re a trader, investor, or miner, preparing for the next crypto halving is crucial. Here are a few tips to help you get ready:

- Stay Informed: Keep an eye on fintechzoom.com and other reliable sources for the latest updates and analysis.

- Do Your Research: Understand the historical impact of halving events and how they’ve influenced the market.

- Develop a Strategy: Whether you’re planning to buy, sell, or hold, having a clear strategy in place can help you make informed decisions.

- Assess Your Risks: Remember that the crypto market is volatile, and past performance is not indicative of future results.

Conclusion: Embrace the Crypto Halving Revolution

In conclusion, crypto halving is more than just a technical event; it’s a catalyst for change in the crypto market. By understanding its mechanics and implications, you can position yourself to capitalize on the opportunities it presents. Whether you’re a miner, investor, or enthusiast, staying informed and prepared is key to thriving in this dynamic landscape.

So, what are you waiting for? Dive into the world of crypto halving, and let fintechzoom.com be your guide. Share your thoughts, ask questions, and engage with the community. Together, we can navigate the exciting journey of digital currencies and shape the future of finance. The ball’s in your court—what’s your next move?

Table of Contents

- What is Crypto Halving Anyway?

- Why Does Crypto Halving Matter?

- The History of Crypto Halving Events

- How Does Crypto Halving Impact Miners?

- The Role of Fintechzoom.com in Crypto Halving

- Predicting the Future: What’s Next for Crypto Halving?

- Long-Term Implications of Crypto Halving

- How Can You Prepare for the Next Crypto Halving?

- Conclusion: Embrace the Crypto Halving Revolution