Let’s talk about NYS income tax, folks! If you’re living in New York State or earning income within its borders, you’re not just dealing with federal taxes—you’ve got the Empire State’s tax system to handle too. NYS income tax is a crucial part of your financial life, and understanding it can save you serious headaches (and maybe even some bucks). So, buckle up, because we’re diving deep into this topic to break it down for you.

You’ve probably heard whispers about how New York’s taxes can be a little... intense. But don’t panic! With the right info and a solid plan, you can navigate the NYS income tax maze like a pro. Whether you’re filing for the first time or just need a refresher, this guide’s got your back.

Before we jump into the nitty-gritty, let me tell you something important: knowledge is power. Knowing how NYS income tax works, what forms you need, and where to find help can make the whole process smoother. So, let’s get started and turn tax time into tax triumph!

Read also:Digital Lifestyle Tv Revolutionizing How We Watch And Experience Entertainment

What Exactly is NYS Income Tax?

Alright, let’s start with the basics. NYS income tax is the tax imposed by the State of New York on the income earned by residents, businesses, and even non-residents who earn money in the state. It’s a key source of revenue for the state government, helping fund everything from schools to infrastructure. Think of it as your contribution to keeping New York running smoothly.

Here’s the deal: NYS income tax is separate from federal income tax, but they do work together. When you file your taxes, you’ll typically file both a federal return and a state return. And yes, New York’s rates can be a bit higher than some other states, but hey, you’re getting a lot in return—world-class cities, stunning nature, and a ton of cultural goodies.

Who Needs to Pay NYS Income Tax?

Not everyone has to pay NYS income tax, but if you fall into one of these categories, you’re likely on the hook:

- Residents of New York State

- Part-year residents who lived in NY for part of the year

- Non-residents who earned income from sources in NY

So, if you’ve got a job in NYC but live in Connecticut, guess what? You might still owe NYS income tax. It’s all about where the money’s coming from and where you’re living during the tax year.

Understanding NYS Income Tax Rates

Now, let’s talk numbers. NYS income tax rates are progressive, which means the more you earn, the higher the rate you pay. Here’s a quick rundown of the current rates:

- Earn up to $8,500? You’ll pay 4%.

- Between $8,501 and $11,700? The rate jumps to 4.5%.

- Keep climbing up the income ladder, and the rates go as high as 8.82% for single filers earning over $1,200,000.

But wait, there’s more! If you’re filing jointly as a married couple, those thresholds are different. For example, the 8.82% rate kicks in at $2,400,000 for joint filers. See what I mean about it being important to understand your situation?

Read also:Ayushi Jawal Rising Star In The Spotlight

How Do These Rates Compare Nationally?

Compared to other states, New York’s income tax rates are on the higher side, especially for higher earners. But remember, some states have no income tax at all. The trade-off? New York offers a ton of services and opportunities that might not be available elsewhere.

Key Forms for Filing NYS Income Tax

Filing your NYS income tax involves a few key forms. Here are the main ones you’ll encounter:

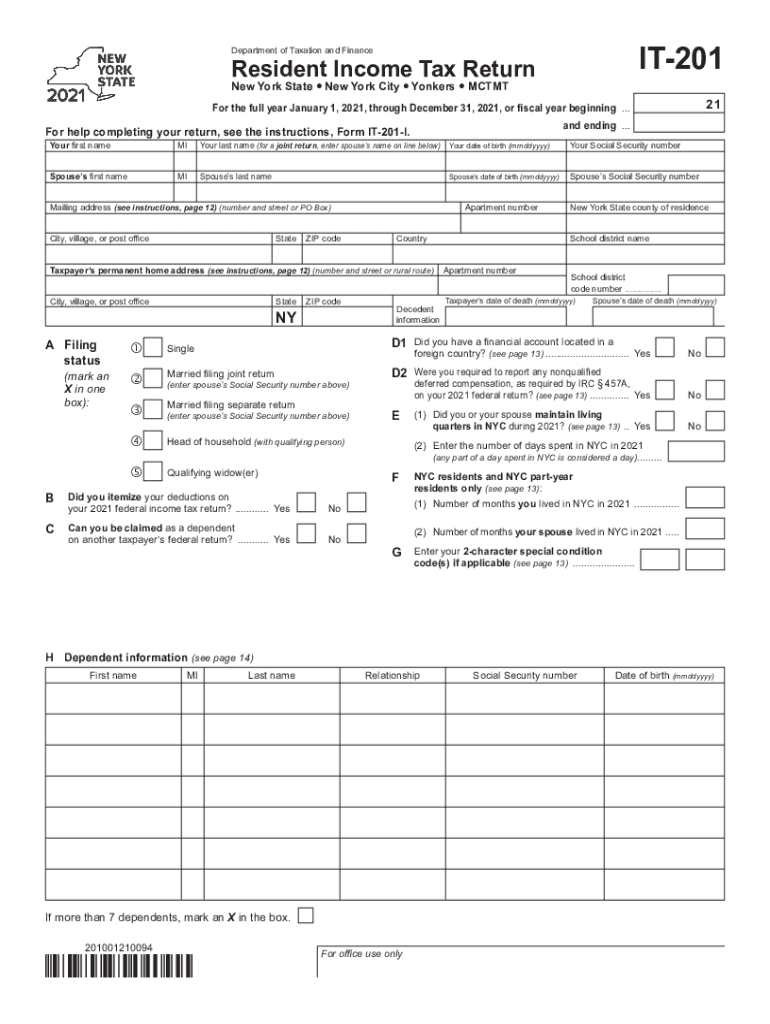

Form IT-201

This is the main form for residents filing their NYS income tax return. It’s like the star of the show when it comes to your state taxes. Make sure you fill it out carefully and double-check all the numbers before submitting.

Form IT-203

If you’re a non-resident or part-year resident, this is your go-to form. It’s specifically designed for folks who earned income in New York but don’t live there full-time. Don’t skip this one if it applies to you!

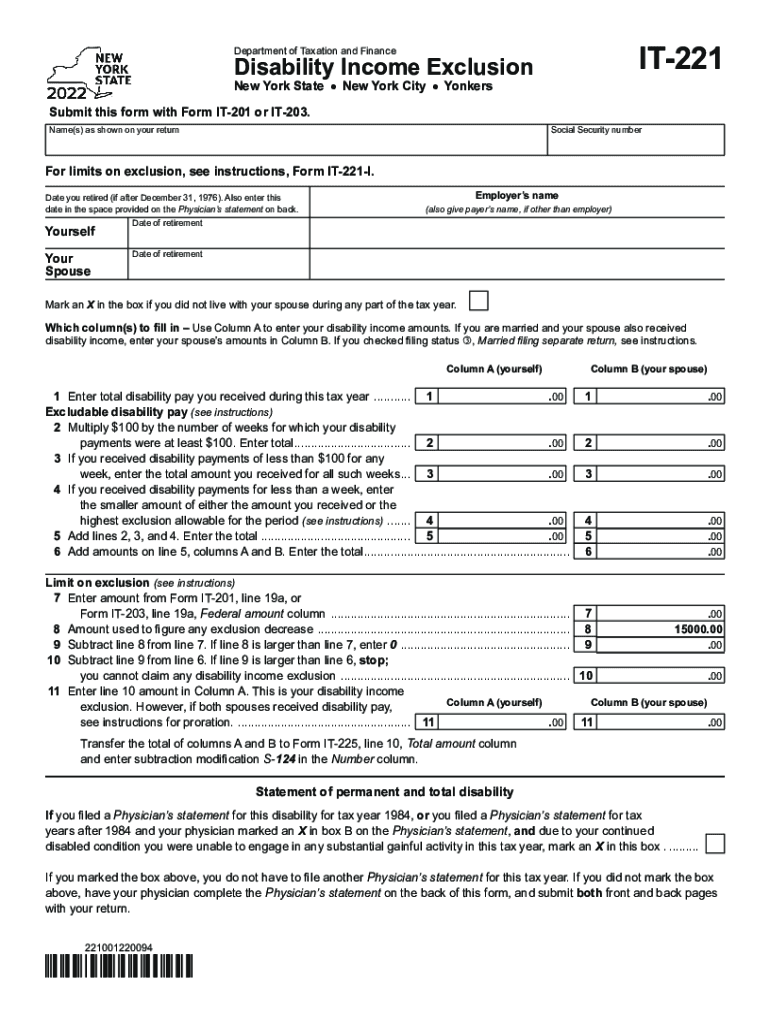

Other Important Forms

Depending on your situation, you might need additional forms, like:

- Schedule Y: For itemized deductions

- Schedule M: For credits and other adjustments

It’s all about knowing which forms you need and gathering all the necessary info before you start. Trust me, it makes the process way smoother.

Deadlines and Late Payment Penalties

Mark your calendars, folks! The deadline for filing your NYS income tax return is typically April 15th, the same as federal taxes. But life happens, right? If you need more time, you can request an extension. Just remember, an extension to file isn’t an extension to pay. You still need to estimate and pay any taxes owed by the original deadline to avoid penalties.

What happens if you miss the deadline? Well, you might face late filing and late payment penalties. These can add up quick, so it’s worth doing everything you can to meet the deadlines. If you’re struggling, reach out to a tax professional—they can be a lifesaver.

What Are the Penalties?

The penalties for late filing and late payment vary depending on how much you owe and how late you are. Here’s a quick breakdown:

- Late filing penalty: 5% of the tax owed per month, up to 25%

- Late payment penalty: 0.5% of the tax owed per month

See why it pays to stay on top of things? Literally.

Tax Deductions and Credits in New York State

Now for the good stuff—deductions and credits! These are your friends when it comes to reducing your NYS income tax bill. Here are a few key ones to know about:

Standard vs. Itemized Deductions

You’ve got two options for deductions: standard or itemized. The standard deduction is a set amount based on your filing status. Itemized deductions let you deduct specific expenses, like mortgage interest or medical expenses, but you’ll need to keep detailed records.

Key Credits

Credits are even better than deductions because they reduce your tax bill dollar-for-dollar. Some important NYS credits include:

- Child Tax Credit

- Earned Income Tax Credit (EITC)

- Property Tax Credit

Take advantage of these if you qualify—they can make a big difference!

How to File Your NYS Income Tax Return

Alright, let’s talk logistics. You’ve got a few options for filing your NYS income tax return:

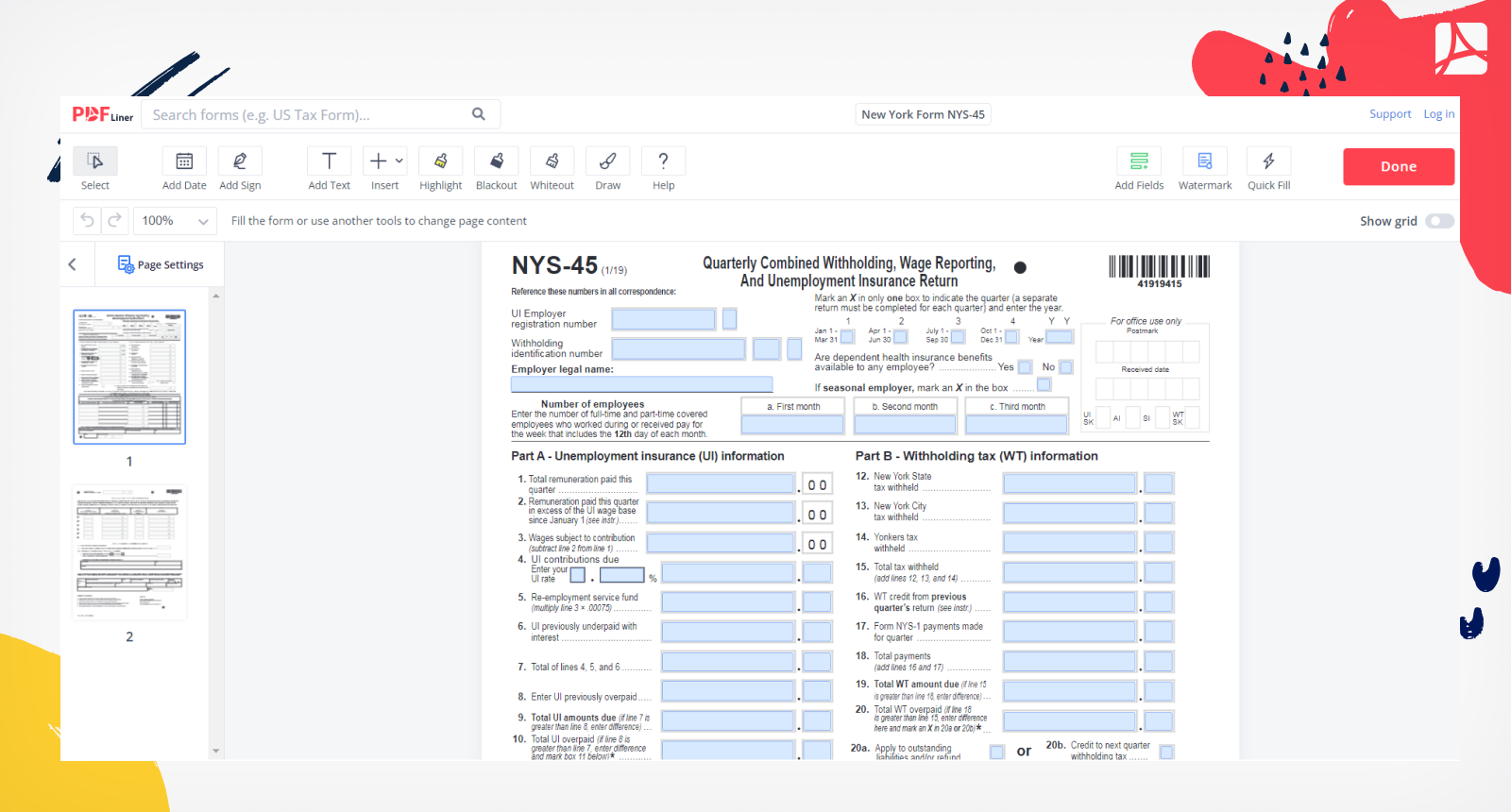

Filing Online

This is usually the easiest and fastest method. You can use the New York State Department of Taxation and Finance’s e-filing system or a third-party tax software like TurboTax. Just make sure you’re using a secure, reputable platform.

Filing by Mail

If you’re old-school or prefer the pen-and-paper method, you can still file by mail. Just make sure you send your forms and payment to the correct address and allow plenty of time for processing.

Getting Help

Not sure where to start? Don’t sweat it. There are plenty of resources available to help you file your NYS income tax return. From free tax prep services for low-income filers to professional tax preparers for more complex situations, you’ve got options.

Tips for Reducing Your NYS Income Tax

Who doesn’t want to keep more of their hard-earned money? Here are a few tips to help reduce your NYS income tax:

- Max out your retirement contributions

- Take advantage of tax-advantaged accounts like 529 plans

- Keep detailed records of all deductible expenses

Every little bit helps, and with a bit of planning, you can make a noticeable difference in your tax bill.

Consulting a Tax Professional

Sometimes, the best way to reduce your taxes is to get expert advice. A tax professional can help you find deductions and credits you might have missed and ensure you’re filing everything correctly. It’s an investment that can pay off big time.

Common Mistakes to Avoid

Even the best of us make mistakes when filing taxes. Here are a few common ones to watch out for:

- Missing deadlines

- Forgetting to report all sources of income

- Not double-checking your math

Take your time and be thorough. Rushing through your tax return can lead to costly errors.

Conclusion: Take Control of Your NYS Income Tax

So, there you have it—a comprehensive guide to NYS income tax. Whether you’re a resident, part-year resident, or non-resident, understanding how this system works is key to managing your finances effectively. By knowing the rates, forms, deadlines, and available deductions and credits, you can minimize your tax burden and maximize your savings.

Don’t forget to take action! File your taxes on time, seek help if you need it, and always keep an eye out for ways to reduce your tax bill. And hey, if you found this guide helpful, why not share it with a friend or leave a comment? Let’s spread the tax-smart vibes!